Property tax is one of the major parts of the revenue of local bodies. The properties whether residential or nonresidential came under its jurisdiction and are assessed to property tax. According to the assessments, property/ house tax is lived on the owner of the property. The owner of the property needs to communicate all information relating to new construction, modifications, and existing construction of the property to the Town Planning Department for making necessary changes to tax assessment. The tax is assessed based on the physical dimension of the property. To know the step-by-step process of Eluru Municipal Corporation File Property Tax Return (PTR) Online, Receipt Download, Search House Tax Details, @elurucorporation.org, kindly go through the complete article below.

elurucorporation.org Eluru MC File Property Tax Return (PTR)

The revenue section of local bodies is responsible for administering the property. For payment of property tax, you need to collect an application form from the office of a local body or the nearest Municipal Corporation. You need to check here all the details before paying of property tax. The Eluru municipal corporation has an online web portal elurucorporation.org but this web portal is under construction till now. After completing this web portal, you will be able to pay property tax online through the official web portal of Eluru Municipal Corporation. It can be accessed 24 X 7 days from any place to check any information.

All residents of Eluru city must pay the property/ house tax on time to avoid penalty charges. By paying property tax before the due date, you will also get some rebate in taxes.

Procedure for Eluru Municipal Corporation Property Tax Online Payment

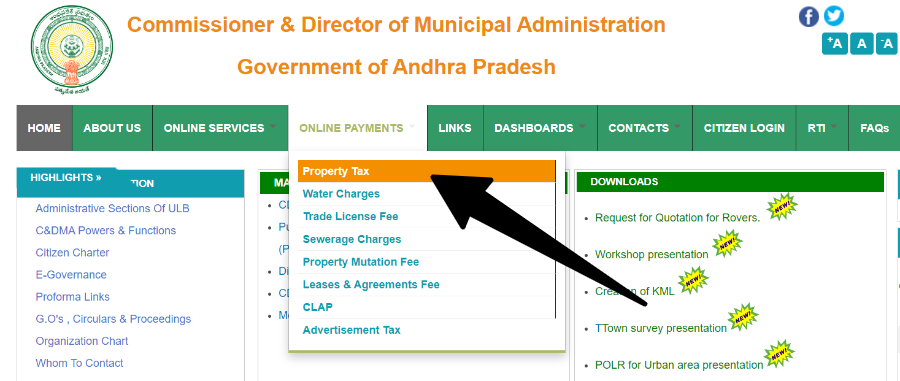

- First of all, you have to go to the official website of the Commissioner & Director of Municipal Administration Government of Andhra Pradesh. Whose link is given below;

Eluru Municipal Corporation => Click Here

- After clicking on this link, the home page will open in front of you.

- Now you have to click on the link of “Property Tax” under “Online Payment” on the home page.

- The page of online payment will open in front of you.

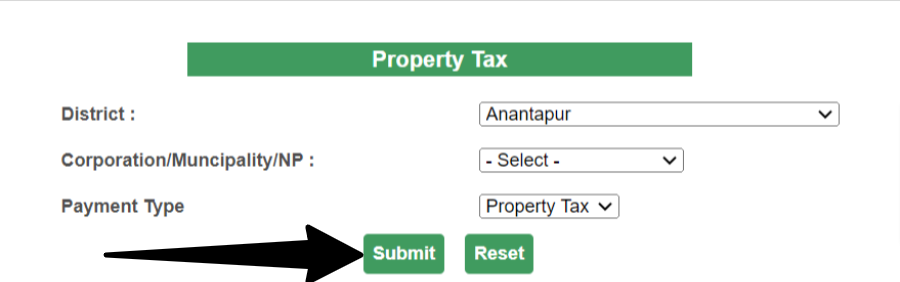

- Here you have to select your district, corporation/municipality / NP, and payment type and click on the “Submit” button.

- As soon as you click, the page “Find Your Property” will open in front of you.

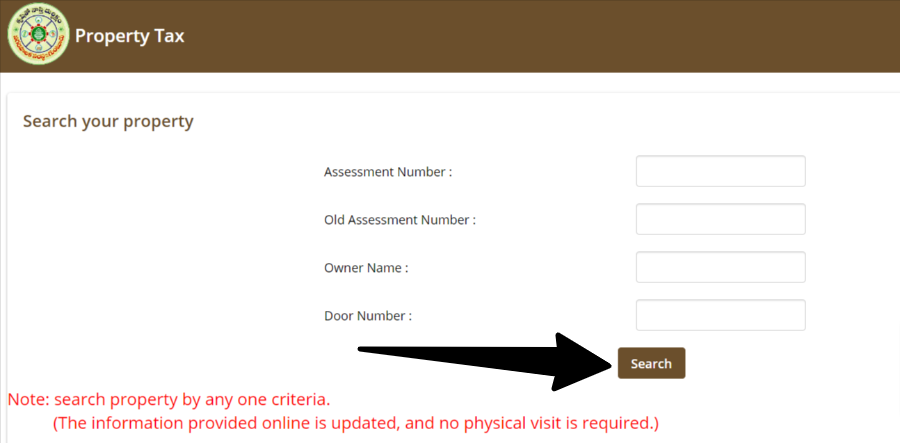

- Here you have to enter the Assessment Number, Old Assessment Number, Owner Name, and Door Number and click on “Search”.

- After this, the complete details of your property tax will open in front of you.

- Now you have to pay your tax by clicking on the payment link and selecting one of the payment options.

Steps for Property Tax Offline Payment in Eluru Municipal Corporation

If you are facing any problem in paying Eluru Municipal Corporation property tax online, then you can also pay it offline by visiting the office. Check out the complete procedure here.-

- To pay the property tax, the applicant has to take the form of a self-assessment of the property tax return, which can be obtained from the office of Eluru Municipal Corporation.

- First, calculate your property tax as per the rules and guidelines given by the Municipal Corporation.

- The next step is to fill the form with the name, address, father’s name, total area of the property, built-up area of the property, and other required details.

- After that, you have to submit the form along with the tax amount to the office of Municipal Corporation Eluru. Do not forget to take the receipt after depositing the property tax.

- For more information related to property tax in Eluru city, visit the below link of Eluru Municipal Corporation and check the property tax details.

How to calculate property tax online in Eluru Municipal Corporation?

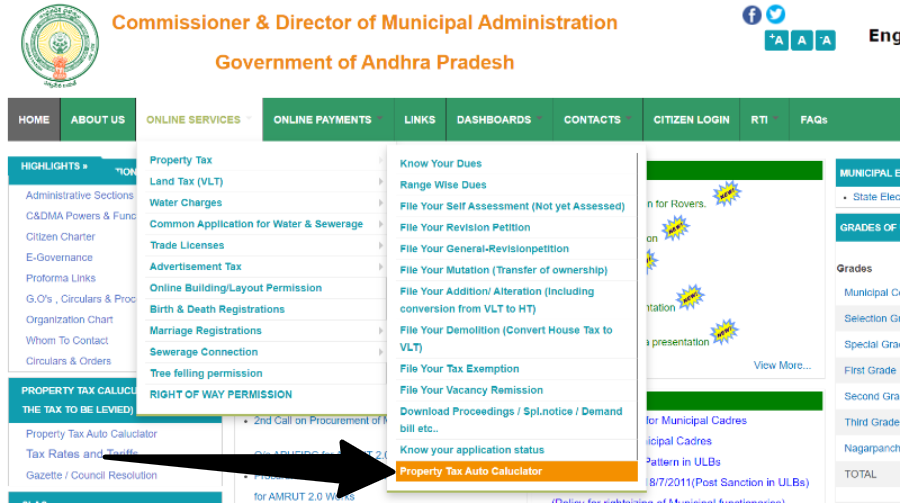

Eluru Municipal Corporation provides the service of online calculation of property tax for which you have to visit the official website to calculate the property tax online. Check out the complete process in detail here-

- Go to the portal of the Commissioner & Director of Municipal Administration Government of Andhra Pradesh or directly click here => https://cdma.ap.gov.in/en

- As soon as you click on the link, you will reach the home page of the official website of the Commissioner & Director of Municipal Administration Government of Andhra Pradesh.

- Here you have to click on Online Service => Property Tax => and then Property Tax Auto Calculator. As shown in the picture below.

- After this, the next page will open in front of you where you have to select District, and Corporation/Municipality/NP and click on “Submit”.

- Now a new page will open in front of you. Here you have to fill in all the information asked correctly.

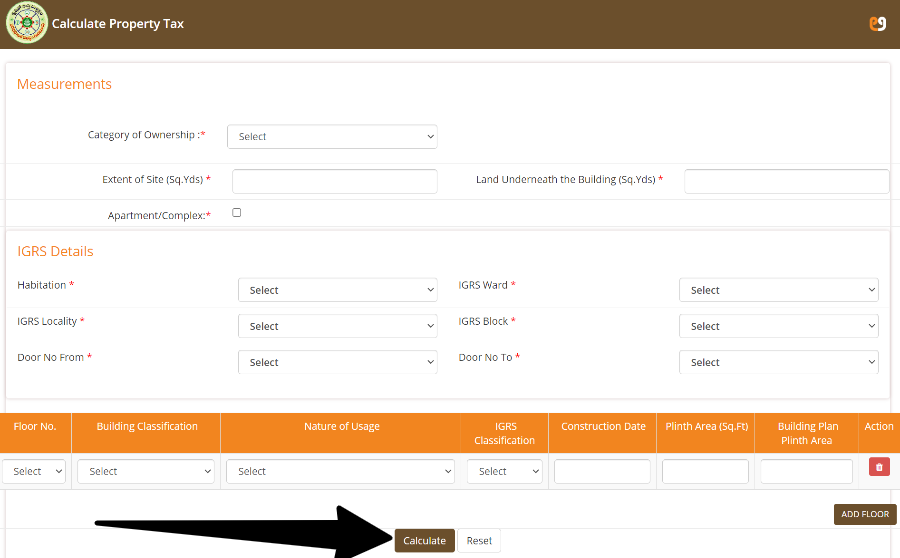

- First of all, information related to Measurements has to be provided.

- After this, details of the Integrated Grievance Redressal System (IGRS) have to be provided.

- Now finally you have to select Floor No., Building Classification, Nature of Usage, IGRS Classification and provide information about Construction Date, Plinth Area (Sq. Ft), and Building Plan Plinth Area.

- Finally, you have to click on “Calculate”. In this way, you can easily calculate your property tax online

Contact Details

| Address | West Godavari, Eluru, Andhra Pradesh |

| Telephone Number | 9849908154 |

| E-Mail ID | [email protected] |

Before payment of property tax in Eluru Andhra Pradesh check the above given detailed steps. It is required to check all details to pay property tax.