Durgapur city is situated in the Burdwan district in the state of West Bengal. This city is the third-largest city in West Bengal in terms of population and area. The total number of areas covered by the Durgapur municipal corporation is 154.20 square kilometers and the total number of inhabitants is five lakhs sixty-six thousand nine hundred thirty-seven. It is headquartered in the Durgapur subdivision. If you’re a resident of Durgapur city and own any property or land in the jurisdiction area then you should pay property/ holding tax for it. Paying holding tax on time is necessary to avoid penalty charges and avail of rebates on taxes. Here we will discuss the complete steps of Durgapur Municipal Corporation Property-Holding Tax Online Payment through this post below.

Durgapur Municipal Corporation Holding Tax Online Payment

There are five community development blocks Durgapur – Faridpur, Galsi – I, Kanksa, Andel, and Pandabeswar, and they also consist of 36 Gram Panchayats and thirty census towns. The second Chief Minister of State West Bengal was Dr. Bidhan Chandra Roy. It is one of the biggest industrial hubs of the state. There are four power plants in the city under the Durgapur Projects Limited (D.P.L) Durgapur Thermal Power Station, Damodar Valley Corporation & N.S.P.C.L, and some chemical and engineering industries.

The property tax is paid on all holdings which are covered under the jurisdiction of Durgapur Municipal Corporation. Assesses any problem that occurs at the time of payment of property/ holding tax or availing any other services provided by the municipal corporation and then checks the contact details given below.

How to Make Holding Tax Payment in Durgapur Municipal Corporation?

- For the property holder to file a holding tax return you need to take an application form of self-assessment of the property tax return. The application form is available in the office of the municipal corporations.

- Then you are required to calculate property tax properly as per the given rules relating to the calculation of property tax.

- After that fill in all details in the application form relating to the property and property owner.

- Submit the form with the tax amount to the nearest municipal corporation office or another concerned authority office. The operator will provide you receipt which contains a transaction reference number, keep it safe.

Durgapur Municipal Corporation => durgapurmunicipalcorporation.org

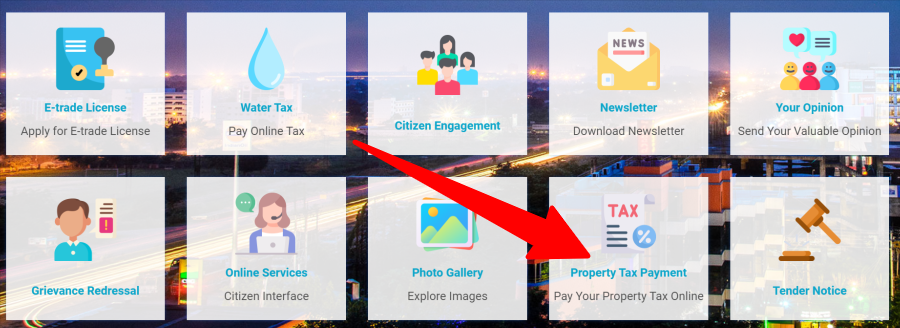

- Above check the link to the official website of Durgapur Municipal Corporation which gives several service options.

- On this web portal, various numbers of services are provided to citizens like applying for a birth certificate, death certificate, water supply connection, and many other services.

-

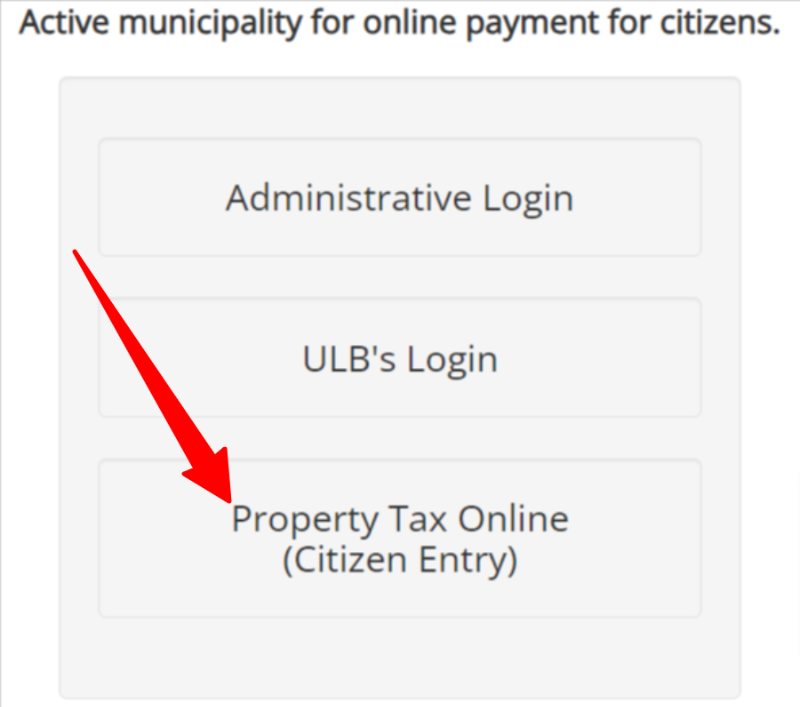

- Click on the Property tax online citizen entry

- Then, Select your district

- Select ULB

- Select Ward

- Select Location

- Select the Holding number and click on to “Proceed” Button

- The Municipal Corporation of Durgapur started the service of online payment of property tax soon but till now the service has been activated by the corporation.

- You need to follow the above-given procedures to file a property tax return until the online property tax payment link is activated by the corporation.

Durgapur Municipal Corporation (DMC) Contact Details

| Address | City Centre, Durgapur, West Bengal- 713216 |

| Telephone Number | 0343 – 2546107 |

| Search Holding Tax | https://holdingtax.co.in/ |

Citizens read procedures for payment of property/ holding tax online in Durgapur Municipal Corporation, West Bengal. Check all details carefully before making the final payment of holding tax on the official site at https://holdingtax.co.in/. Also, don’t forget to download the payment receipt for further reference.