Pune Municipal Corporation (PMC – Pune Property Tax Online – https://pmc.gov.in/) raised Rs 200 crore by selling 10-year bonds in the last fiscal year. Pune Nagar Nigam – PMC has become the first municipal corporation to raise money through this route in the last 14 years. The Corporation will spend 7.59% of the coupon rate on the water project of Rs. 2,300 crore. The Corporation Commissioner said that we will raise funds in the next five years in a manner according to the project’s payment schedule. This issue was being handled by SBI Capital Market, which was subscribed 6 times over. Below check the pmc.gov.in Pune Municipal Corporation File PTR Online, Self Assessment Registration, Dues, Receipt Download, Search House Tax, and other related details.

pmc.gov.in Pune Municipal Corporation File PTR Online

It had received the value of Rs 1,200 crore. The Pune Municipal Corporation (PMC) commissioner said, ‘We have seen financial strength. We have planned for 30 years to increase our tariff, which is a source of revenue. We have also got political support for this scheme. ” He said that other bodies should be encouraged to adopt this approach.

The Pune Nagar Nigam commissioner said that Pune Municipal Corporation will prepare a case study, in which the experience of working on this method and other things will be shared with other bodies. So that it will benefit other bodies too. After this, the union said that a new era had started in municipal finance. Pune Municipal Corporation has created history. If you’re a resident of Pune City and own any property or house in the jurisdiction area then you must pay the property/ holding tax before the due date to avoid penalty charges.

Pune Property Tax Online – Pay House Tax Online in PMC

- If you have a property under the Pune Municipal Corporation (PMC) and are willing to pay the due house tax then you are on the right website.

- Here we are providing you Pune Property Tax Online official website link where you can see the option “Pay Property Tax”.

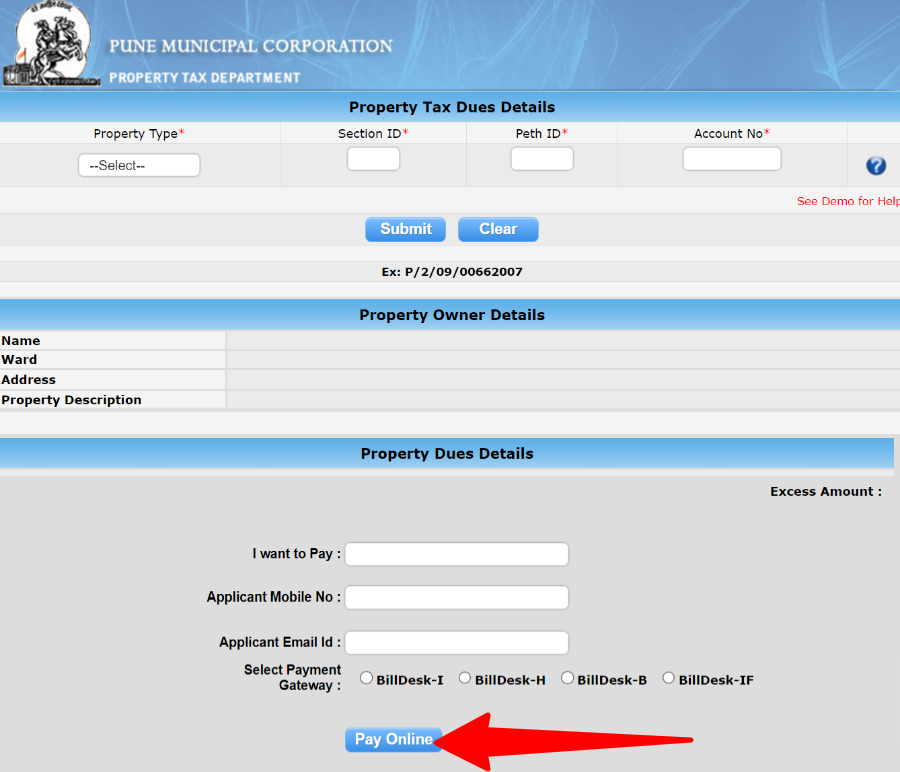

- Now on the next page, you will get the “Property Tax Dues Details” page of Pune Property Tax Online. On this page you will have to enter “Property Type, Section ID, Peth ID, and Account No” (For Example – P/3/07/00553008). These all details are available on your old property tax bill. After providing all the information press the “Submit” button.

- After following the above procedures you will see the “Property Owner Details” section under Pune Property Tax Online. In this section, you will see the following information:

-

- Firstly property owner’s name.

- Secondly, select the ward from the given list.

- Thirdly write the complete property address.

- Fourthly fill in the previous owner’s name.

- Fifthly enter the current owner’s name.

- In the second section of the same page you will see the “Property Dues Details” in which you will have to fill in the following details:

-

- I Want to Pay – Firstly fill in the amount here which you want to pay in favor of Pune Municipal Corporation (PMC).

- Applicant Mobile No – Secondly fill in your 10-digit currently registered mobile number in Pune Nagar Nigam.

- Applicant Email ID – Thirdly enter your current registered email address in PMC.

- Select Payment Gateway – Select one payment gateway from BillDesk-I, BillDesk-H, BillJunction-I, and BillDesk-B.

Then just press the “Pay Online” button and you will see the payment page just after this one. On that page, you will have to use a credit/debit card or internet banking to file the Property Tax Return amount in Pune Municipal Corporation (PMC). after making the payment download the receipt for future assistance regarding Pune Property Tax Online. The Pune Nagar Nigam will update your profile within 3 working days.

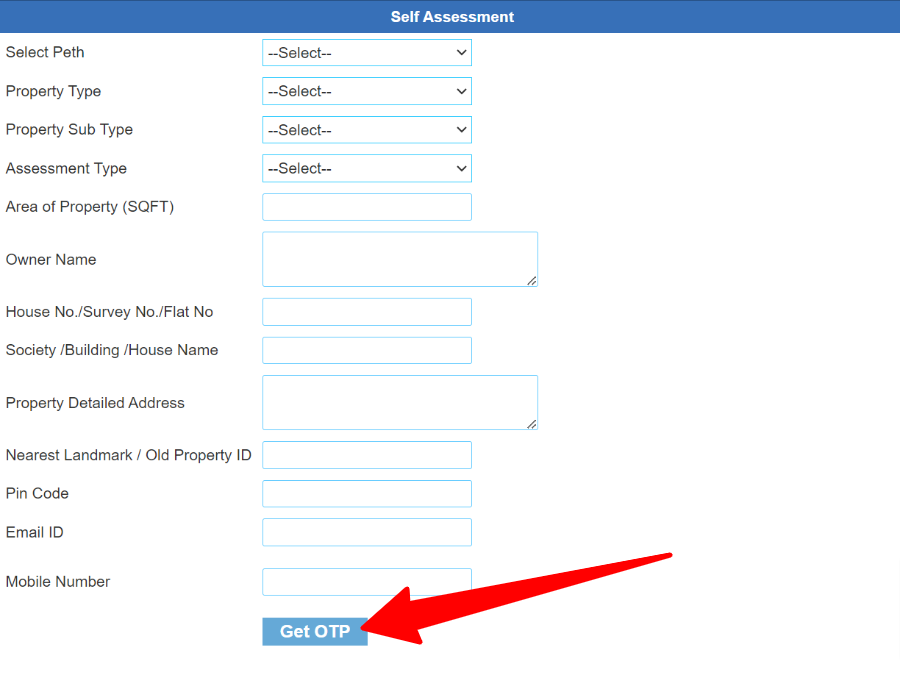

Self-Assessment of Property in PMC

For filing the self-assessment before the Pune Property Tax Online you just have to check the below link where this option is available. The citizens can file the Self Assessment of Property in Pune Municipal Corporation by filling out a simple form. You will have to fill in the following information on this page and then press the “Submit” button.

- Select Peth

- Property Type

- Area of Property (SQFT)

- Owner Name

- Property Address

- Nearest Landmark / Old Property ID

- Mobile Number

- Email ID

Pune Municipal Corporation (PMC) Contact Details

The citizens also can take assistance from the officials in case of any problem. If you need help filing the property tax return – PTR or self-assessment then here are the contact details.

| Office Address | PMC Main Building, Near. Mangla Theatre, Shivajinagar, Pune – 411005 |

| PMC Contact No | 25501000 (STD Code 020) |

| Toll-Free Helpline | 1800 1030 222 |

| Official Email Id | [email protected] [email protected] |

| Property Tax Site | http://propertytax.punecorporation.org |

If You Need Any Help, We Are Here! For further Assistance Please Submit a Comment Below!