Burdwan Municipality was incorporated in 1865 with a total area of 12.8 square kilometers and a population of thirty-nine thousand eight hundred eighteen. At present, the total area covered by the Burdwan Municipality is 26.30 square kilometers. The population of the town as per census record 2001 is two lakhs eighty-five thousand six hundred two. At present, the total number of wards in the corporation is thirty-five in numbers. If you’re a resident of Burdwan and own any property (residential or commercial) then you should file the property tax returns on time to avoid penalty charges. To learn How to Pay Burdwan Municipality Property-Holding Tax Online, kindly go through the complete article below.

Burdwan Municipality Property-Holding Tax Payment

Property or holding tax in the town of Burdwan is collected by the Burdwan Municipality in its jurisdiction. The property tax is a major part of the revenue of Burdwan Municipality which is used to keep up civic amenities in the city. As we all know the property tax plays a vital role in the development of the city. The municipality maintains and constructs roads, and provides water supply in the city. Burdwan Municipal Corporation is administered by the state government of West Bengal.

The functions and responsibilities of the municipality are given in the West Bengal Municipal Act, 1993. It also gives rules for the calculation of property tax. It is easy to pay property tax in the city of Burdwan like other cities. All the properties assessed by the municipality are required to file property tax returns. You can also check here your property details with the help of the property ID and assessment number which are provided by the municipality on the official site at www.burdwanmunicipality.gov.in Bardhaman Municipal Corporation Property Tax Online, Check Self-Assessment of House Tax Return, etc.

How to Pay Property Tax Online in Bardhaman Municipal Corporation?

To pay property/ holding tax online in Bardhaman Municipal Corporation, you have to follow the steps given below;

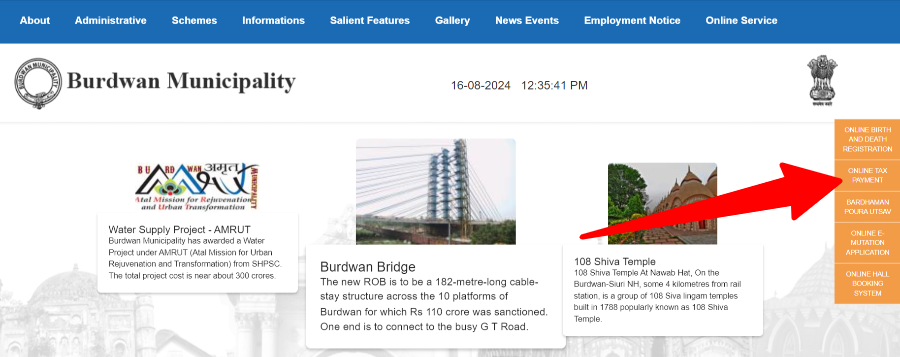

- First of all, you have to visit the official website of Bardhaman Municipal Corporation or directly click here => https://burdwanmunicipality.gov.in/.

- Here on the home page, you have to click on the option of “Online Tax Payment”.

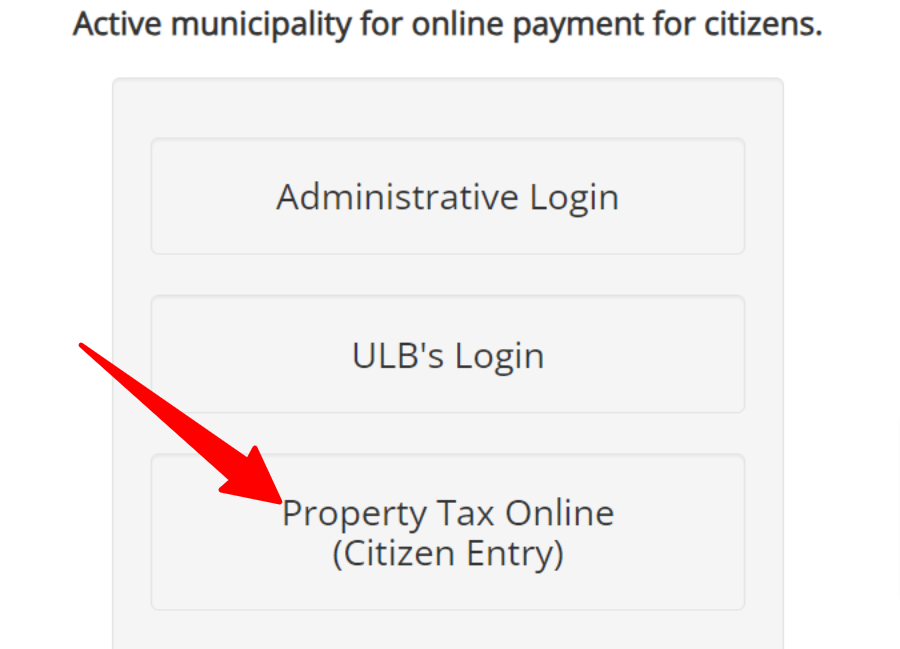

- After this, the next page will open in front of you where you have to click on Property Tax Online (Citizen Entry).

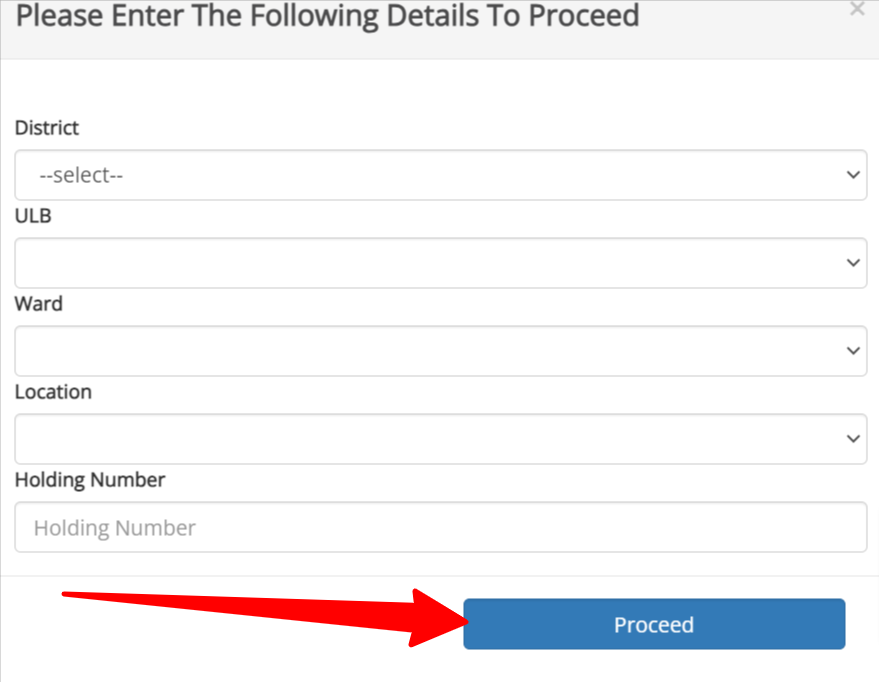

- As soon as you click, the next page will open in front of you, here you have to enter the following details.

-

- District

- ULB

- Ward

- Location

- Holding Number

- After filling in all the information, you have to click on “Proceed”.

- Then your complete property tax details will open in front of you.

- Next, you have to click on “Pay Now”. And complete the payment process.

- Now you will receive a message of successful payment. After this, you can download the payment receipt by clicking on the print button.

Steps for Holding Tax Offline Payment in Bardhaman Municipality

- Payment of property tax requires a Self Assessment of Property Tax Return (SAS) application form which is available in the office of the Municipal Corporation or other concerned authority offices.

- The second step is to calculate property tax as per the rules given by the municipal corporation. You need to check all aspects required for payment of property tax.

- The third step is to fill correct property and owner of property details in the form. You also need to provide property tax details in the form.

- After filling form you need to go to the neatest circle office of the Municipal Corporation and submit the SAS form along with the tax amount to the operator. The operator will issue a receipt after verification of all details, and safely preserve it.

Contact Details

| Address | G.T. Road, Burdwan, West Bengal- 713101 |

| Telephone Number | (0342) 2662518, 2664121, 2662777 |

| Fax Number | 2560717 |

| E-Mail ID | [email protected] |

Citizens read procedures for payment of property tax online in Bardhaman Municipality, West Bengal. Check all details carefully before making the final payment of property/ holding tax at https://burdwanmunicipality.gov.in/ Also, don’t forget to download the Burdwan Municipality Property Tax receipt for further reference.