Chittoor Municipal Corporation was constituted in the year 1917 as the third grade of the municipality and upgraded to a second-grade municipality in the year 1950. In the year 2000, it was upgraded to a selection municipality and upgraded to a corporation on dated 7th September 2012. The area of the corporation was spread over an area of 69.75 square kilometers. There are a total of fifty-one elected wards in the corporation.

The corporation includes fourteen villages named Annabelle, Bandapalle, Doddipalle, Kukkalapall, Mangasamudram, Mangasamudram, Mapakshmi, Murakambattu, Muthirevula, Narigapalle, Ramapuram, Thenabanda, Thimmsanipalle and Varigapalle merged with the corporation. Property tax is a liability on the property owner and is collected by the municipal corporation. Property tax is calculated on the annual rental value of the property. There are different property tax rates for the calculation of property tax. You need to fill out the form of self-assessment of a property tax return for the payment of property/ house tax online.

Chittoor Municipal Corporation Property Tax Payment

- Those who want to pay property tax need to take the application form of Self Assessment of Property Tax Return (PTR) can be availed from the nearest municipal corporation office.

- You can also check rates of calculation of property tax and calculate property tax according to rules specified by the corporation. There is a different rate of property tax in different areas.

- Fill all details in the form with the correct details and then submit the form and deposit the tax amount to the corporate office or other concerned authority.

- Collect receipt after payment of property tax which mentions the date and transaction number which is used for future reference.

How to Make Chittoor Municipal Corporation Online Property Tax Payment?

If you want to pay property/ house tax online in Chittoor Municipal Corporation, follow the below procedure:-

- First of all, go to the official website of the Commissioner and Director of Municipal Administration, Government of Andhra Pradesh by directly clicking here => https://cdma.ap.gov.in/en

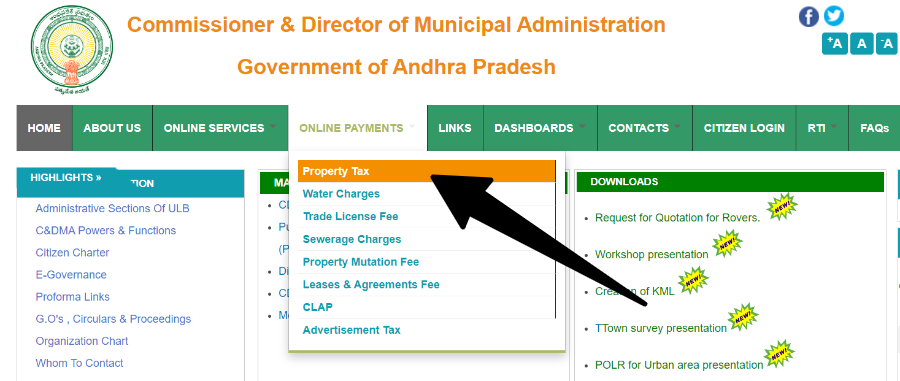

- Now you have to click on the link of “Property Tax” under “Online Payment” on the home page.

- After this, the online payment page will open in front of you.

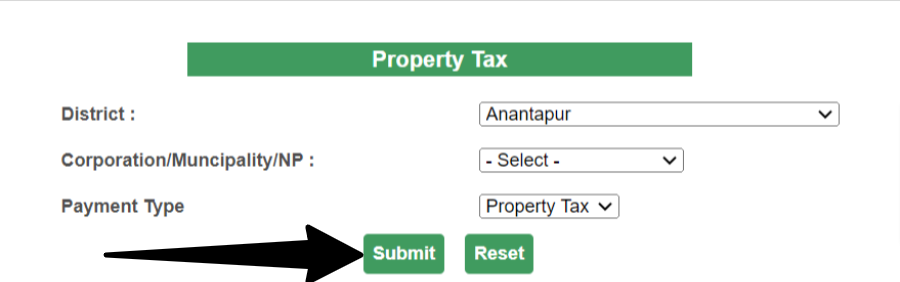

- On this page, you have to select your district, corporation/municipality/NP, and payment type and click on the “Submit” button.

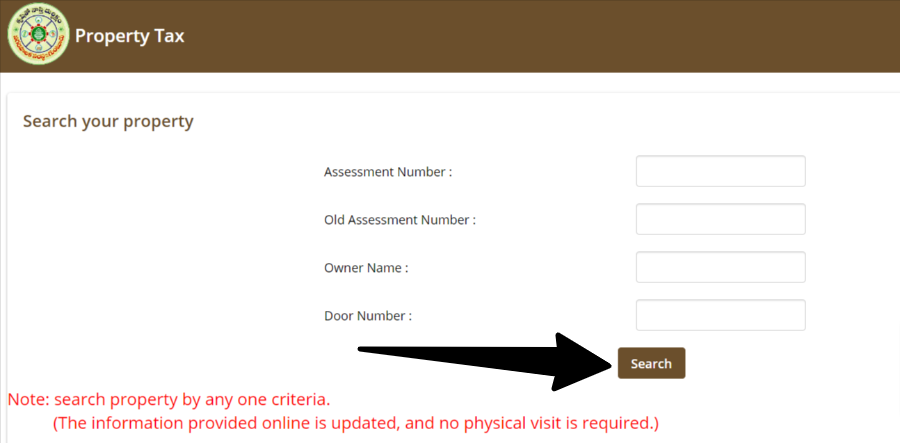

- Now you will reach the “Search Your Property” page. Here you have to enter the assessment number, old assessment number, owner’s name, and door number and click on “Search”.

- After this, the complete details of your property tax will open in front of you. Here you have to pay your tax by clicking on the payment link and choosing one of the payment options.

Steps to Calculate Chittoor Municipal Corporation Property Tax Online

If you also want to calculate Chittoor Municipal Corporation property tax online, then for this you have to follow some easy steps. These are as follows:-

- First, you have to visit the website of the Commissioner & Director of Municipal Administration Government of Andhra Pradesh. Below you have been provided its direct link –

Calculation of Property Tax Online => Click Here

- As soon as you click on the link, you will reach the home page of the official website of the Commissioner & Director of Municipal Administration Government of Andhra Pradesh.

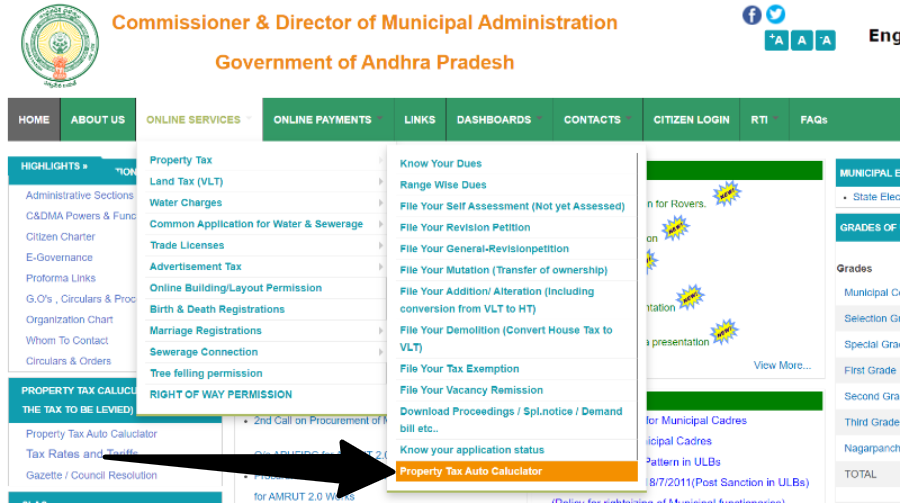

- Here you have to click on Online Service => Property Tax => and then Property Tax Auto Calculator. As shown in the picture below.

After this, the next page will open in front of you where you have to select District, and Corporation/Municipality/NP and click on “Submit”.

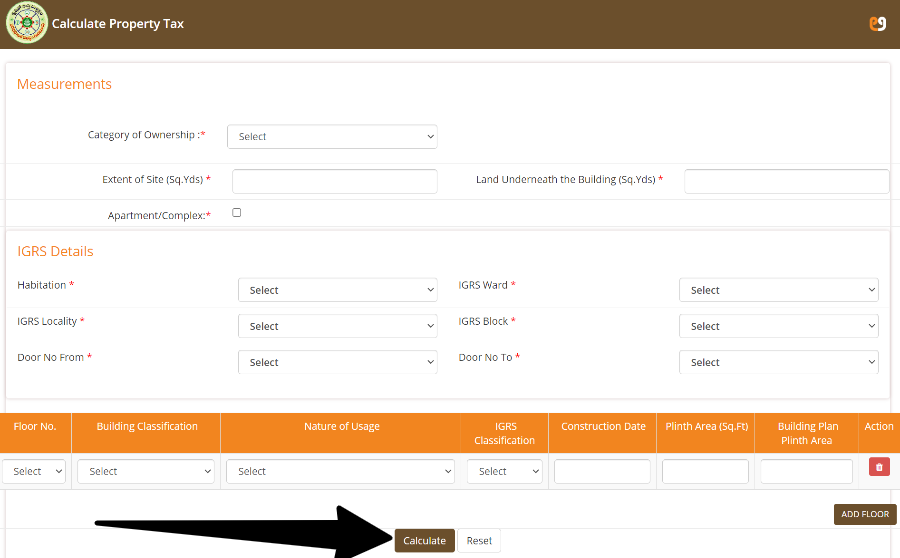

After this, the next page will open in front of you where you have to select District, and Corporation/Municipality/NP and click on “Submit”.- Now a new page will open in front of you. Here you have to fill in all the information asked correctly.

- First of all, information related to Measurements has to be provided.

- After this, details of the Integrated Grievance Redressal System (IGRS) have to be provided.

- Now finally you have to select Floor No., Building Classification, Nature of Usage, IGRS Classification and provide information about Construction Date, Plinth Area (Sq. Ft), and Building Plan Plinth Area.

- After this, finally, you have to click on “Calculate”. In this way, you can easily calculate your property tax online

Contact Details

| Address | KR Palli, Chittoor Puttur Rd, opposite municipal office, KR Palli, Chittoor, Andhra Pradesh 517001 |

| Contact No. | 98499 05864 |

Check here the steps for payment of property tax online in Chittoor Municipal Corporation, Andhra Pradesh. You need to check all details before making the final payment of property/ house tax. Don’t forget to download the CMC Property Tax Bill Receipt for further reference.