Durg is the city of Chhattisgarh state and it is a part of the Durg-Bhalia urban agglomeration. The main occupation of the city is agriculture and engaged in milling rice and pigeon peas. The city of Durg is also known for its steel plant after the Bhilai steel plant. In the city of Durg, other endorsed important industries are brassworking, bell metalworking, oil pressing, mining, and weaving. It is the second-largest city in Chhattisgarh state based on population. If you’re a resident of Durg city and own any property or land in the area then you should file the property-house tax return online before the due date. To know the complete process of Durg Municipal Corporation Property/ House Tax Payment Online, kindly go through the complete article below. Here we have discussed all the methods to pay taxes.

Durg Municipal Corporation Property/ House Tax Payment

The population of Durg city as per census record 2011 is two lakhs sixty-eight thousand eight hundred six. Durg district covers the southeast part of Chhattisgarh state. The Municipal Corporation of Durg has the responsibility to manage civic amenders in the city. There are several other functions and responsibilities of the Durg Nagar Nigam that are covered under the Municipality Act. The property tax is levied by the governing authority of the jurisdiction in which the property is located.

Sometimes, more than one governing authority charges property tax on a single property. There are different rules of different governing authorities to charge property tax. It is the responsibility of the citizen to calculate property tax properly and effectively on property and deposit to the municipal corporation office or another concerned authority office before the due date. The corporation gives a rebate to the assessee on property tax if paid within the specified time limit. And special rebate is given on residential properties. It is required to calculate property tax before making the final payment of property/ holding tax.

Procedure to File Property Tax Return Online in Durg Municipal Corporation

- The first step for payment of property tax is to visit the official web portal of Chhattisgarh Municipal Corporation. Below the direct link of Chhattisgarh Municipal (Nagar Nigam) is given a click on it.

Durg Municipal Corporation => Click Here

- As soon as you click on the link, the home page of the Chhattisgarh Municipal website will open in front of you.

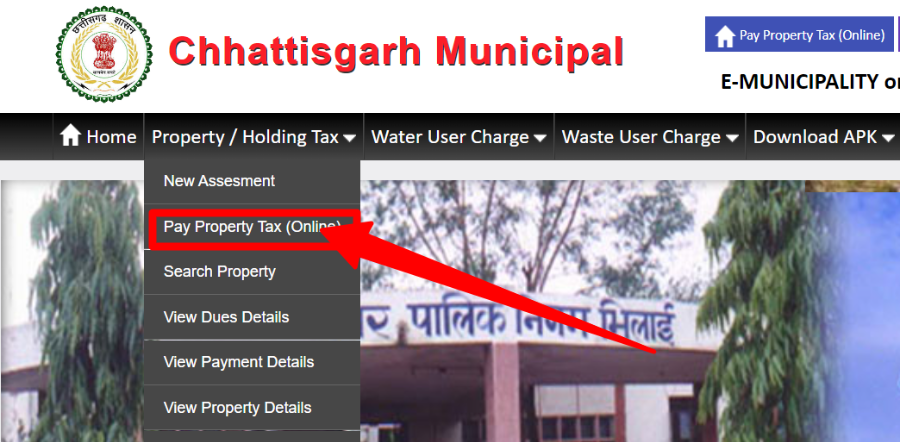

- Here you have to click on the link “Pay Property Tax (Online)” under “Property / Holding Tax”.

- After this, a new page will open in front of you. As shown below.

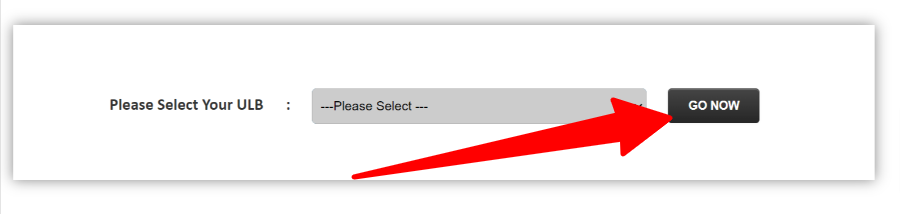

- Now you have to enter Urban Local Body (ULB) here and click on “Search”.

- Then a form will open in front of you. Fill in the information asked here correctly and click on “Submit”.

- After this, the complete details of your property tax will open in front of you.

- Click on the Pay Now button to pay property tax online.

- After successful payment of property tax, print or note the transaction number and date given on the screen.

How to Download Property Tax Assessment Application Form?

- Here on the official website of Durg Municipal Corporation, you can also download the form of self-assessment of the property tax return in PDF form to pay property tax through manual method.

- See the direct link to the application form for the assessment of property tax.

Form of Self Assessment of Property Tax Return (PTR) => Click Here

- Fill out the application form with all details such as name, address, property ID, assessment number, and other required details.

- After that submit the form along with the tax amount to the office of Durg Municipal Corporation.

Durg Municipal Corporation (DMC) Contact Details

| Office Address | In front of labor court Gaurav Path, Durg (Chhattisgarh) |

| Phone Number | 0788-2322148 |

| FAX No. | 0788-2322148 |

| Email ID | [email protected] |

Read here the steps for payment of property tax online in Durg Municipal Corporation, Chhattisgarh. Carefully check all details before paying the property/ house tax.