Khammam is one of the famous towns of the Telangana state. There are so many historical places in the town of Khammam. The Khammam town came into existence on 24th March 1942. Let us tell you that Khammam town was divided into 11 revenue wards and 41 election wards. In the year of 2012, the Khammam Municipality was given the name of Municipal Corporation with the addition of none gram panchayats. Currently, in the town of Khammam, there are a total of 20 revenue wards and 50 election wards. Property tax is an important part of revenue for local bodies and local municipal authorities. To know the complete process of How to File a Self-Assessment of Property Tax Return in Khammam Municipal Corporation, keep on reading ahead.

Khammam Municipal Corporation Property Tax Payment

The authorities of the Municipal Corporation made a survey and assessment to check property details. Based on such assessment taxes are levied on property owners according to area and size of the property. A taxpayer must pay property tax annually. To file a self-assessment of property tax, the citizen has to register with the local body for taxation and assessment.

You can check all types of details relating to property tax assessment. Citizens can check all the details from the official web portal of Khammam Municipal Corporation manakmc.com. It provides you with the online facility to file property tax. You need to check the file form of self-assessment of property tax. All residents of Khammam must file their property/ house tax returns on time to avoid penalty charges. Below check the step-by-step process to Pay Property Tax Online and download the payment receipt.

How to File Self Assessment of Property Tax Return in Khammam (ఖమ్మం మున్సిపల్ కార్పొరేషన్ వద్ద ఆన్లైన్ ద్వారా మీ ఆస్తి పన్ను రిటర్న్ ఫైల్)

- To file a self-assessment of property tax, you need to download a form of self-assessment from the official web portal of Khammam Municipal Corporation.

Khammam MC => https://khammamcorporation.telangana.gov.in/

- Here you can check your property details online. Download the form of self-assessment of property tax return or take it from the office of the Municipal Corporation.

Next, fill in all contact numbers and detailed addresses on the form. Next, you require some documents to be attached to the form, check the given list.

-

- Patta / Registered documents issued by Tahsildar with stamp and signature.

- Photograph of building

- Copy of approval of building plan.

- Self-assessment form

- Occupancy certificate

- At last, submit your form with all documents to the office of the Municipal Corporation. After submitting the form you need to collect the receipt which is used for future reference.

Know Your Property Tax Details => Click Here

- In case of any problem at the time of payment of the property tax return you need to visit the office of the Municipal Corporation.

How to Calculate Khammam Municipal Corporation Property Tax?

If you also want to calculate Khammam Municipal Corporation property tax, then for this you have to follow the following steps.

- First of all, go to the official website of Khammam MC @khammamcorporation.telangana.gov.in.

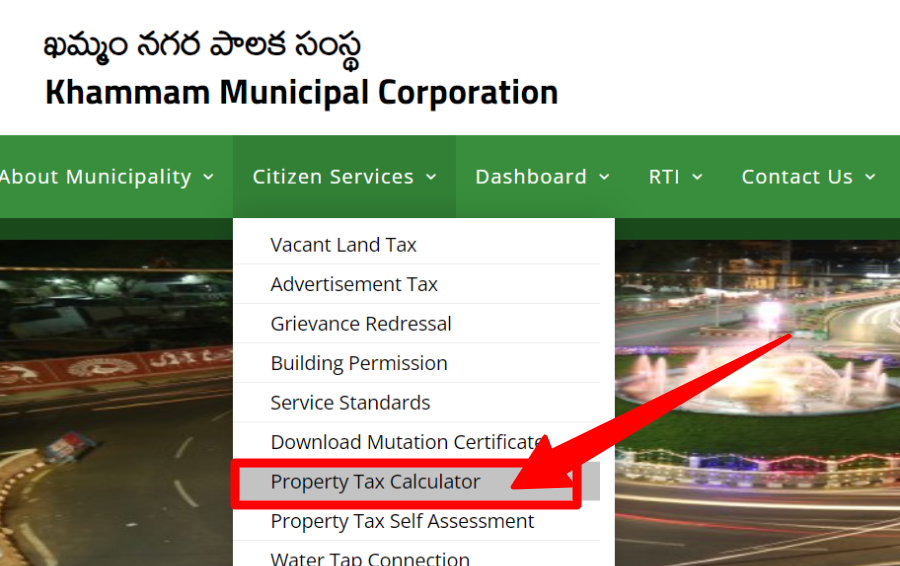

- Here you have to click on the link of “Property Tax Calculator” under “Citizen Services” on its home page.

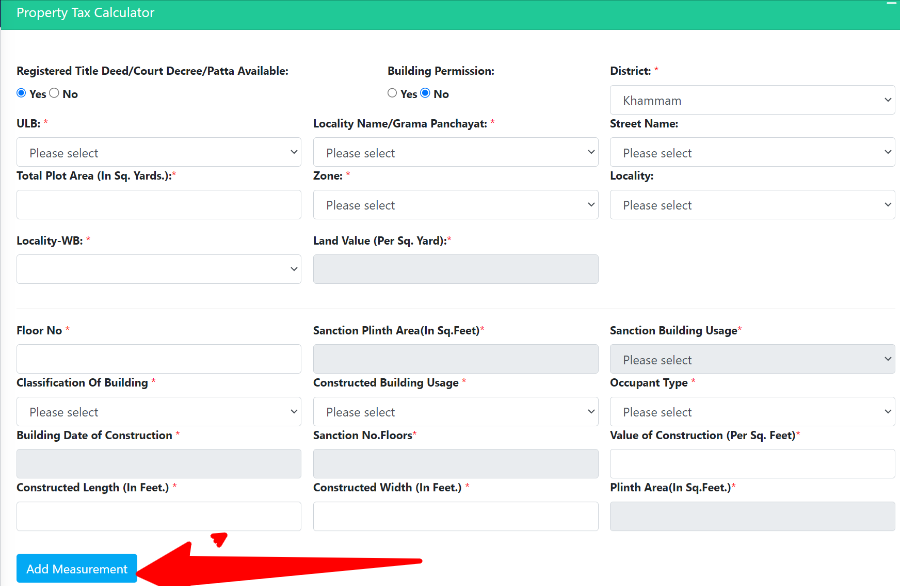

- As soon as you click, the next page will open in front of you. Where you have to fill in the asked information.

- You have to provide information about Registered Title Deed / Court Decree / Patta Available, and Building Permission.

After this, you have to select District, ULB, Locality Name / Gram Panchayat, Street Name, Total Plot Area (In Sq. Yards.), Zone, Locality, and Locality-WB.

After this, you have to select District, ULB, Locality Name / Gram Panchayat, Street Name, Total Plot Area (In Sq. Yards.), Zone, Locality, and Locality-WB.- Now you have to provide information related to the Floor and click on “End Measurement”.

- In this way, you can easily calculate your property tax online.

Khammam Municipal Corporation (KMC) Contact Details

| Address | Main Road, Gandhi Nagar, Khammam – 507001 (Gandhi Nagar) Telangana |

| Email ID | [email protected] |

| Mobile | 079012-98265 |

Citizens here read step by step to file property tax returns in Khammam, Telangana. Read all the steps carefully before filing a property tax return and don’t forget to download the payment receipt for future use.