Hyderabad is the capital of Telangana state of India. As of 2010, it is the sixth most populous city in India. In 1591, Muhammad Quli Qutub Shah established the city of Hyderabad on the banks of the Mussi River. Today the city is spread over an area of approximately 650 sq km. However, the Hyderabad and Secunderabad twin cities fall under the purview of the Greater Hyderabad Municipal Corporation (GHMC). Hyderabad has evolved into one of the major centers for the information technology industry in India.

In addition to the IT industry, various biotechnology and pharmaceutical companies are set up in Hyderabad. In the city, Banjara Hills and Jubilee Hills are the most expensive residential real estate in Telangana. To know more details about GHMC Property Tax Online Payment, Search House Tax Details, and Download Payment Receipt @onlinepayments.ghmc.gov.in, keep scrolling down below.

Greater Hyderabad Municipal Corporation (GHMC) Property Tax

Under the property tax payment service, the citizens are the options for “Property Tax Payment, Search Your Property Tax, and Print Receipts” services available for citizens. For the online services, the official website www.ghmc.gov.in is available. If you’re a resident of Hyderabad and Secunderabad twin cities and own any property or house in the jurisdiction area then you must pay the property/ holding tax before the due date to avoid penalty charges. To learn How to Pay Property Tax Online in GHMC, kindly go through the complete article below. Here check all the service procedures and make the payment online to avoid the penalty.

Procedure for GHMC Property/ House Tax Online Payment

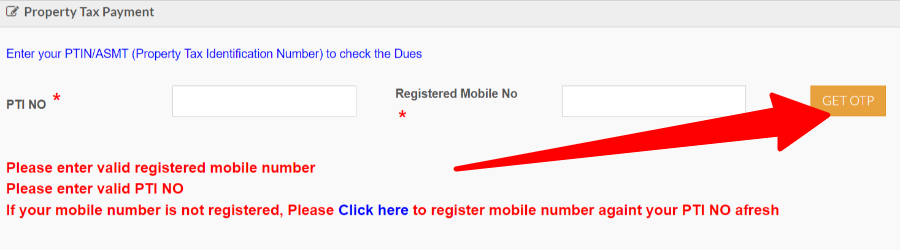

First, visit the official website where the “ONLINE PAYMENTS” option is available for submitting the dues. Check the below link and go directly to the payment page. On this page, you will see the option “Enter your PTIN/ASMT (Property Tax Identification Number) to check the Dues”.

On this page enter the “PTI No” and then press “Know Property Tax Dues”. After pressing this button you will see the new payment page. Use your credit/debit card or net banking mode for the payment of your property tax online.

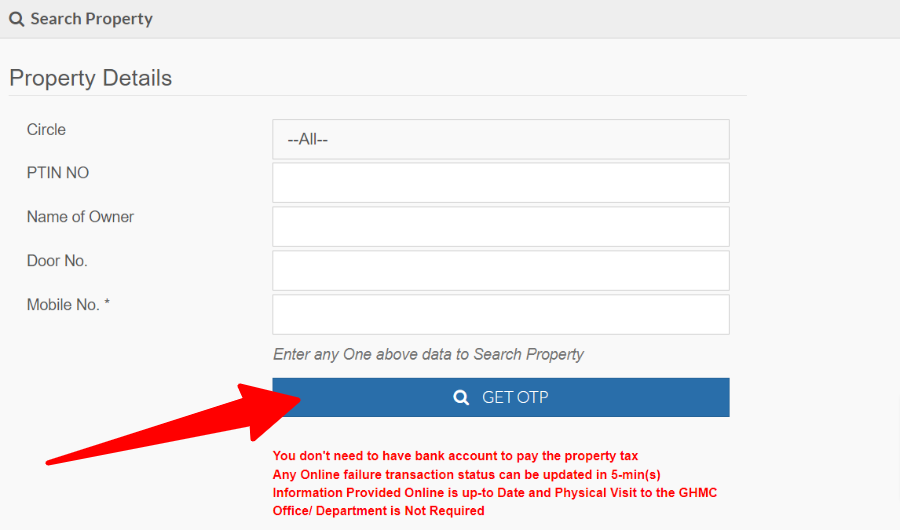

GHMC Search & Know Your Property/ House Details

To know your property or to search the house details simply visit the below link. In this page enter one detail from “Circle, PTIN No, Name of Owner or Door Number”. Then press the “Search Property Tax” button.

Now you can see the complete property details and the due amount of your tax which you have to pay online through the above method.

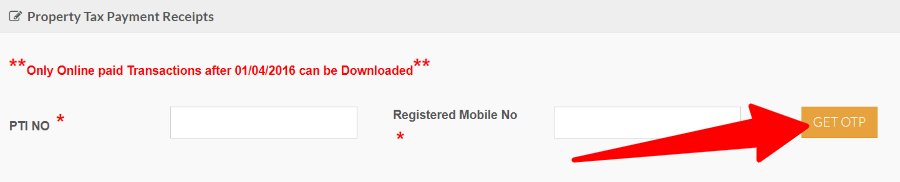

GHMC Online Property Tax Payment Receipts

If you forget to download the GHMC Online Property Tax Payment Receipt, go to the below link page. On this page enter the “PTI No” and then click on the “Display Receipt” option.

Apply for Mutation of Property Tax Online Greater Hyderabad Municipal Corporation (GHMC)

To apply for the mutation service you have to visit the CSC center or the nearest Deputy Commissioner’s office. The citizens will have to pay 0.1% of the market price of the property through the Demand Draft – DD.

You have to make the payment in favor of the Greater Hyderabad Municipal Corporation (GHMC) Commissioner. Then a tax inspector will visit the property for verification and he/she will check all the documents.

After that, the deputy commissioner will check all the documents related to the mutation he/she will approve it. With the mutation application form attach the following documents:

- Firstly, Attach a duly signed notice of transfer for the property by the seller and buyer under Section 208 of the GHMC Act.

- Secondly, Also, attach all the property documents in the attested copy.

- Thirdly Rs 20 non-judicial stamp paper with the application form.

- Fourthly Affix a copy of the latest encumbrance certificate.

- Fifthly Rs 50 Affidavit um indemnity bond for undertaking on an affidavit after notarization.

- Sixthly All paid tax receipts.

- Seventhly In case of the owner’s death attach a death certificate or legal heir certificate.

Contact Details

| Address | CC Complex Tank Bund Road, Lower Tank Band Hyderabad: 500063 |

| Website | www.ghmc.gov.in |

| Helpline | 21111111 |

| Phone No. | 040-23225397 |

If You Need Any Help, We Are Here! Please Submit comments below!