Property Tax is a direct tax amount, which is paid by the owner of an immovable property by the value of that property. The estimate of this tax is based on the property value. It is not important whether the owner has any benefit from that property. In this way, according to the original definition property tax is normally done by municipalities on the owners of real estate located in their jurisdiction, which is based on the value of that property. If you live in Greater Visakhapatnam city and own any property (residential or commercial) then you should file the property tax returns on time to avoid penalty charges. To learn How to Pay GVMC Property/ House Tax Online and GVMC House Tax Status Check, kindly go through the complete article below.

Greater Visakhapatnam Municipal Corporation (GVMC) Property Tax Bill

This tax mainly applies to land, land improvement, man-made movable commodities such as houses, houses, shops, buildings, etc. The nature of this tax can be different in different countries. Taxation of Property Tax in India has been done under the Property Tax Act, of 1957. The Income Tax Department administers property tax rules by making the Property Tax Act, of 1956, and under it, under the Department of Revenue in the Ministry of Finance, Government of India.

In India, the real owner of the property deposits this tax while tenants in the United Kingdom are also liable to pay this tax. The citizens will have to pay the property tax on an annual basis in India. Generally, this tax is levied based on the fair rent. Often people consider property taxes and fix to be one, but both of these are different. In the event of a non-rental property, the value of the property is calculated based on the local tax rate. Below check the step-by-step process of GVMC Property Tax Online Payment and Receipt Download.

GVMC Property Tax Online Payment in Greater Visakhapatnam

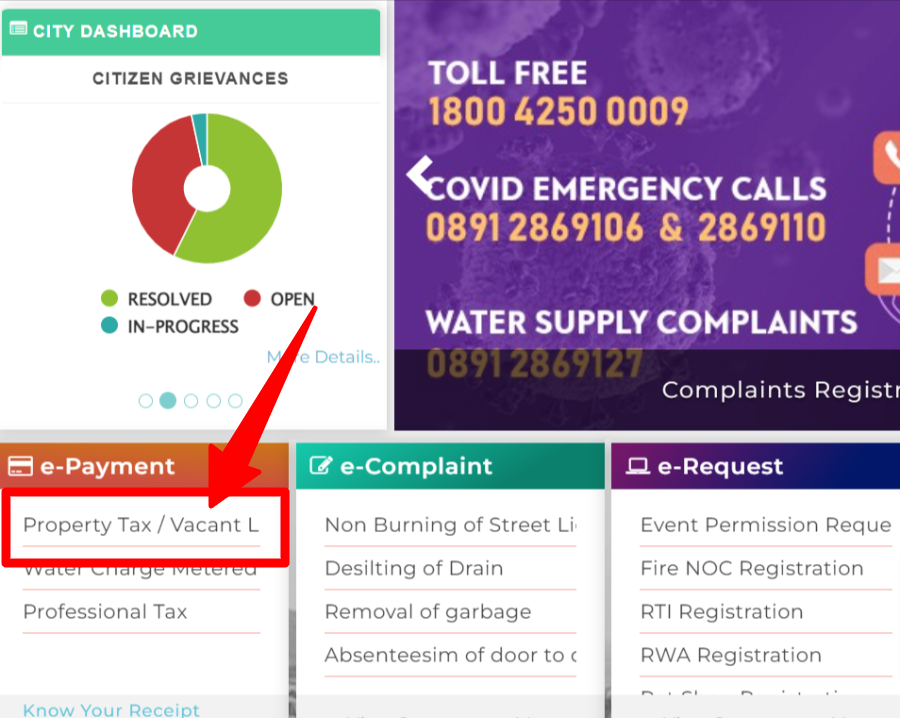

- First, all of you will have to visit the official website of GVMC Andhra Pradesh AP at https://www.gvmc.gov.in/ where under the “e-Payment” section you can check the option of “Property Tax/Vacant”. See the image of the official website home page and option.

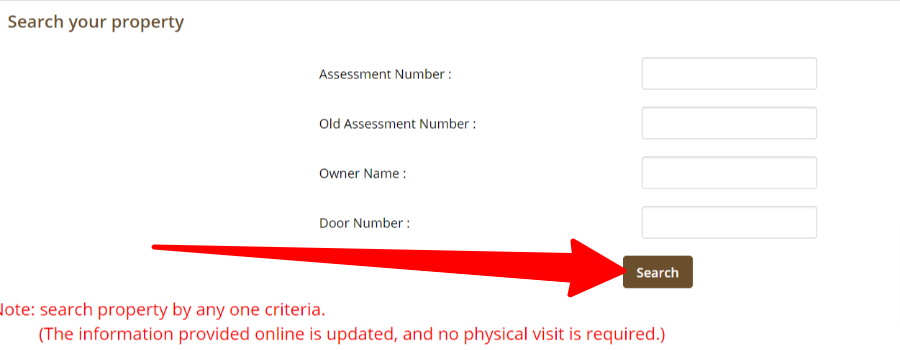

- After clicking on the above option you can see the new page as shown in the image below. You also can reach directly to the payment page by providing the link here.

- On this page enter your “Assessment Number, Old Assessment Number, Owner Name, and Door Number”. Now press the search button.

- By pressing the search button you will be able to see all details of your due payments. The citizens will have to pay in favor of Greater Visakhapatnam Municipal Corporation – GVMC.

- You can pay the GVMC Property Tax or File PTR 2023-24 by using your credit/debit card or net banking.

- In the last step download the payment receipt and take the printout in plain paper for future assistance.

Greater Visakhapatnam Municipal Corporation GVMC Helpline

For any solution, we will suggest you use the GVMC’s helpline number. If you are having any doubts related to the GVMC Property Tax then call the below number. The officials will give you all the solutions.

GVMC Toll-Free Helpline Number = 180042500009

If You Need Any Help, We Are Here! Please Submit comments below!