The city of Jaipur is known as the pink city. It is famous for its embroidery and beautiful clothes. There are so many historical places in the city. It is a very beautiful city in the Rajasthan state. The total population of Jaipur city is around 35 lakhs and the total area covered by the city is approximately four hundred sixty-seven square kilometers. Jaipur City is divided into a total of eight zones and ninety-one wards. If you’re a resident of Jaipur Nagar Nigam (Greater) then you must file the property/ house tax returns before the due date to avoid penalty charges. Below check the complete process of Jaipur Nagar Nigam Property-House Tax Online Payment on the official site @jaipurmc.org or @rajmunicipal.com/public/search_property/ and download the Payment Receipt for the same.

Jaipur Nagar Nigam House Tax Online Payment

The city hot spots are Hawa Mahal, Jantar Mantar, Forts of Amber, Nahar Garh, Sisodia Rani Garden, Albert Hall, City Palace., Birla Auditorium, Jawahar Circle, Rajmandir Cinema, Chokhi Dhani Fun and Eating Joint, Revolving Restaurant, Rose Garden, GovindDev Ji Temple, etc. In the city of Jaipur to make payment of property tax you are required to visit the official web portal of Jaipur Municipal Corporation jaipurmc.org through which you can make payment of property tax online.

Now residents can easily file an online application form for a birth certificate, or death certificate. It also provides an application form for self-assessment of the property tax return in PDF form. The corporation to provide online services developed an online web portal. You can check your property tax details here online. You require service to file online self-assessment of property tax return online. Rajasthan Municipal website @rajmunicipal.com/public/search_property/ is the website where all taxes are paid online.

jaipurmc.org File Self-Assessment of Property Tax Return Online

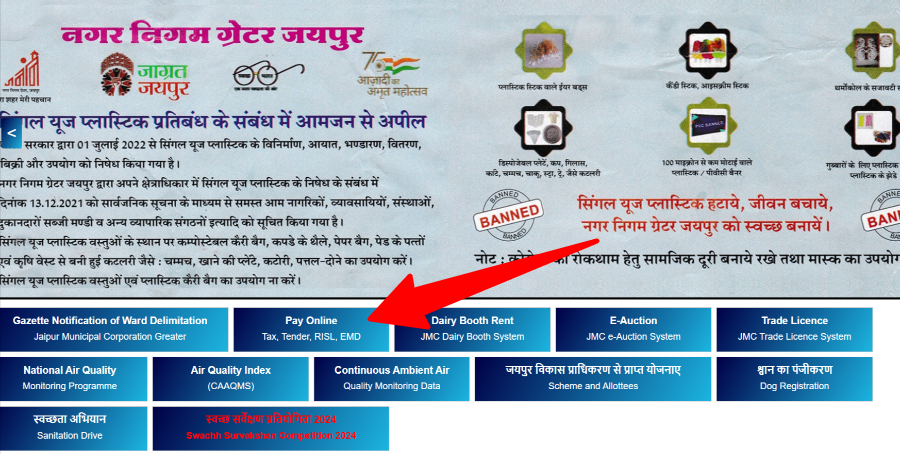

- To file a self-assessment of the property tax return you need to open the official web portal of Jaipur Municipal Corporation or directly click here => http://jaipurmc.org/Jp_HomePagemain.aspx

- On clicking the above link, the home page of Jaipur Municipal Corporation will open in front of you.

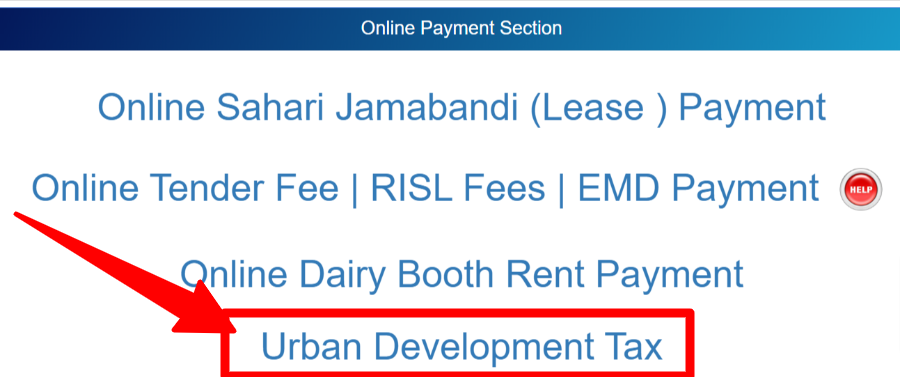

- Here you have to click on “Pay Online Tax”. The next page will open in front of you, where you have to click on the “Urban Development Tax” link.

- After this, you will reach the official website of Municipal Corporation Rajasthan @rajmunicipal.com.

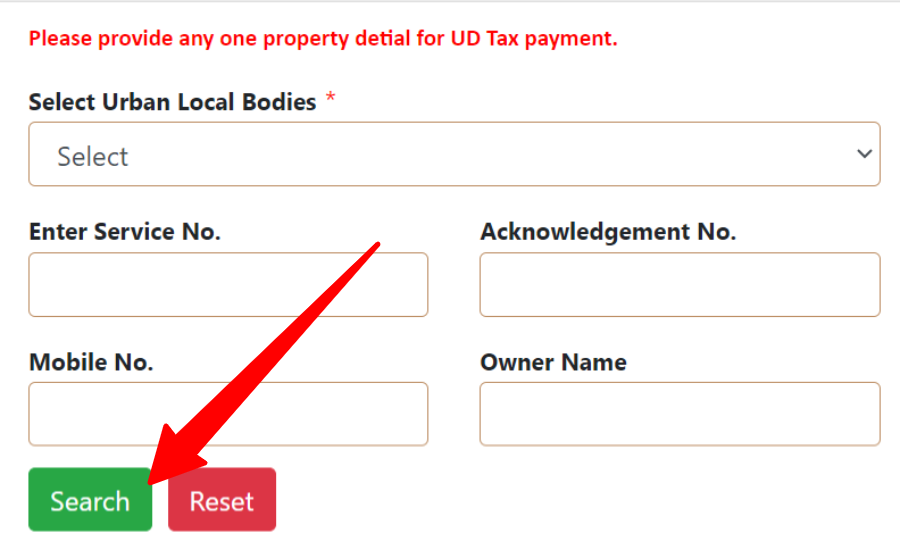

- You have to select Select Urban Local Bodies, enter your Service No, Acknowledgement No, Mobile No, and Owner’s name, and click on “Search”.

- Next, the complete details of your Property Tax will open in front of you. Here you have to click on “Payment Now”.

- On clicking, the payment page will open in front of you. From here you have to select the options of online payment. And the payment process has to be completed.

- Finally, you have to click on Print and get the payment receipt.

Manual Step to File Self Assessment of Property Tax Return (PTR)

Applicant if you want to make payment of property tax then you have to take an application form of self-assessment of property tax. You can download the form from the official web portal of the corporation take it from the office or check the below link for the form.

Form of Self Assessment of Property Tax Return => Click Here

- After getting the form, you need to calculate your property tax according to the tax rates of the location in which your property is located.

- Fill in all details in the application form as the name of the owner, address, and property details.

- All details in the form should be correct in all respects.

- Submit the form along with tax charges to the office of Jaipur Municipal Corporation and collect receipts used for future reference by the taxpayer.

Contact Details @rajmunicipal.com Search Property Tax

| Office Address | Pandit Dindayal Upadhyay Bhawan, Lal Kothi Tonk Road, Jaipur, Rajasthan, INDIA |

| Telephone Number | 0141 – 2741424 |

| Fax Number | 0141 – 2741424 |

| E-Mail ID | [email protected] |

| Control Room Number | 0141 – 2742900 |

| Citizen Helpline Number | 0141 – 5110111 |

| JMC Call Centre | 1800 180 6681 (toll free) |

| Official Websites |

|

The user here read all the details that are required to file payment of property/ house tax in Jaipur city. Carefully check all details to file a self-assessment of your property tax return online at rajmunicipal.com/public/search_property/. Also, don’t forget to download the payment receipt for further reference.