Jalpaiguri Municipality came into existence in the year 1886-87 with a population of seven thousand none hundred thirty-six under the chairmanship of Deputy Commissioner of the District and Vice-Chairmanship of Civil Medical Officer. In the year 1916-17, the first non-official chairman was elected. The Jalpaiguri municipality’s total area is divided into seven wards which consist of nineteen commissioners. In the year 1967, after independence the area of the municipality was divided into a total of nineteen single-member constituency wards and the area of the municipality is 10.095 square kilometers. If you want to know How to Pay Property/ Holding Tax in Jalpaiguri Municipal Corporation, kindly read this article ahead as we have covered all the details regarding holding tax payment.

Jalpaiguri Municipal Corporation Holding Tax Payment

The area of Jalpaiguri increased to 12.95 square kilometers in the year of 1995. Jalpaiguri municipality aims to make Jalpaiguri city a modern, economical, eco–friendly green city. The municipality will provide a friendly environment for employees and better civic amenities to the citizens of the city. It collects municipality tax from all covered under its jurisdiction.

Property tax is assessed based on an annual rental of property which differs from area to area, ward to ward. The corporation provides an online grievance service that can be accessed at any time and provides immediate results. If you’re a resident of Jalpaiguri and own any property or land in the area then you must file a property tax return online before the due date. The Jalpaiguri Municipality is an authorized urban body to collect the property/ holding tax from the citizens. Follow this post ahead for more details.

Steps for Pay Property Tax Online in Jalpaiguri Municipal Corporation

Jalpaiguri Municipality has developed an online website that provides online services to the citizens. So if you also want to pay your property/ holding tax online, then check out the complete process here;

- First, you have to visit the official website of Jalpaiguri Municipal Corporation.

- Or directly click here => https://holdingtax.co.in/

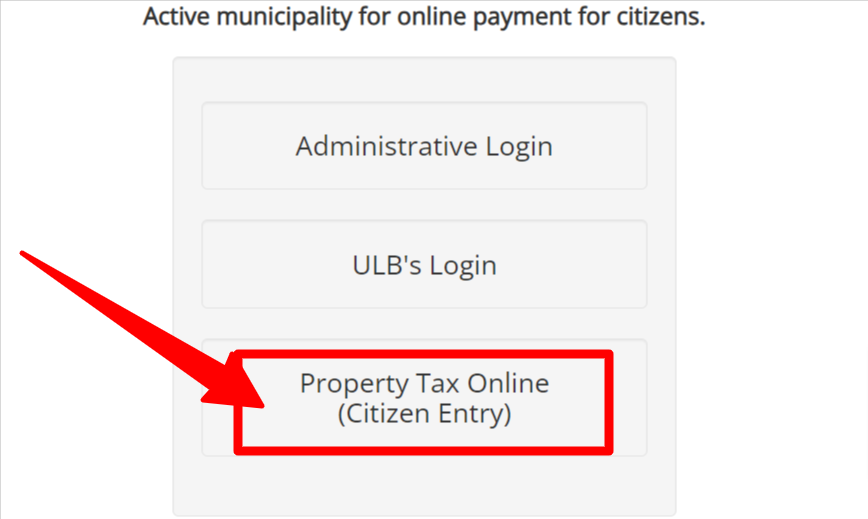

- Here you have to click on the option of “Property Tax Online (Citizen Entry)” on its home page.

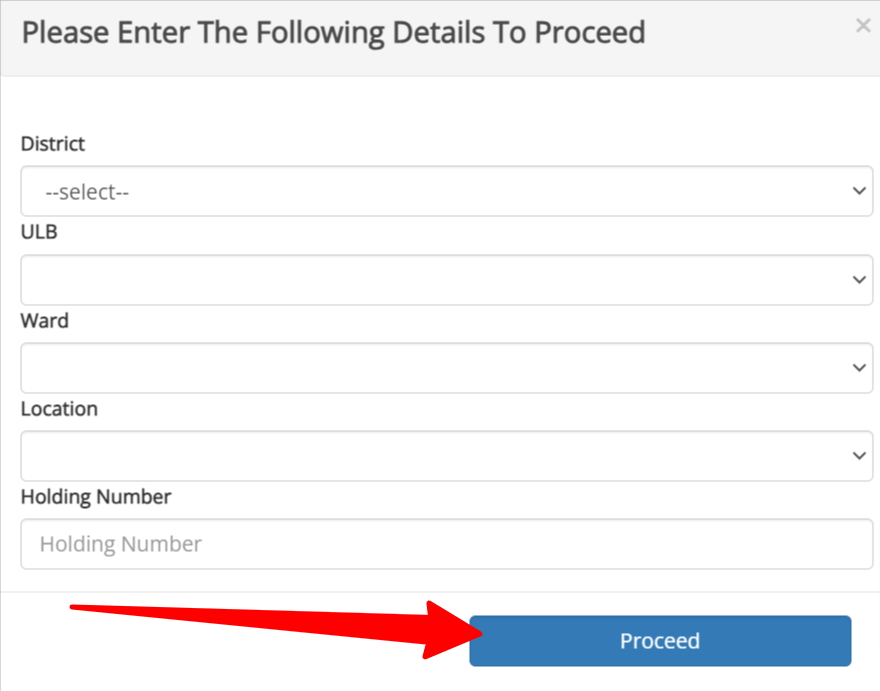

- As soon as you click, a page will open in front of you. Where you have to enter District, ULB, Ward, Location, and Holding Number and click on “Proceed”.

- After this, the complete details of your Profile and Property Tax will open in front of you.

- Now you have to click on “Proceed” to pay your property tax here.

- a pop-up box will appear in front of you where you have to enter your mobile number, and email ID and select the payment option.

- After this, you have to complete the payment process. After successful payment, you will be informed through SMS.

- Finally, you can get the receipt of payment by logging in.

How to file Jalpaiguri Municipality Property Tax Return Offline?

If you also want to file the Jalpaiguri Municipality property/ holding tax return offline, then for this you have to follow the below steps;

- For this, you have to calculate your property tax before filing the taxpayer property tax return.

- To pay the property tax, you have to get the application form for self-assessment of a property tax return from the municipality office.

- Now fill in all the details in the form like the property owner’s name, address, assessment number, property ID, mobile number, email ID, etc. Fill out the application form.

- The last step is to submit the filled application form along with the tax amount to the municipality office and take the receipt after payment which will be used for future reference.

Jalpaiguri Municipality Contact Details

| Contact Number | 03561230050, 03561 231096. |

| Address | Police Line Rd, Jalpaiguri, West Bengal 735101 |

| jalpaigurimunicipality[at]gmail[dot]com |

A user here checking the steps for payment of a property/ holding tax return in Jalpaiguri Municipality, West Bengal. Read all the details carefully before making the final payment of property tax.