Jodhpur is the second-largest city in Rajasthan state after Jaipur, the largest city in Rajasthan. It is one of the most visited cities in the state. There are so many numbers of tourist and historical places which are quite impressive. Because of so much tourism, many large and big companies established their corporations. Jodhpur city was known as the capital of the great kingdom of Marwar in the earlier period. To check property tax details you need to visit the official website of Jodhpur Municipal Corporation jodhpurmc.org. It provides you with several other services. If you want to Pay Property-House Tax Online in Jodhpur Municipal Corporation then you should visit the official site @nnjsouth.in. Follow this article ahead to learn how to file a property tax return online.

Jodhpur Municipal Corporation Property-House Tax Payment

Now there is no need to go round and round to make payment of property tax. The property tax is collected by the respectable municipal corporation of the area. The main aim of the Municipal Corporation is to provide and maintain civic amenities in the city, village, town, and district. From time to time, a concerned officer of the corporation assesses all details and passes an order to those who are liable to pay property tax. Those who are assessed need to pay property tax annually.

Taxpayers also receive a rebate of tax amount if the deposit amount is on time according to the Municipal Corporation Act. It requires a checking step before online payment of property tax. All residents of Jodhpur City must file the property/ house tax return before the due date to avoid penalty charges. Below we have shared the complete process of Jodhpur MC Property Tax Online Payment.

Procedure for Jodhpur Nagar Nigam Property Tax Online Payment

To make online payment of property/house tax in Jodhpur Municipal Corporation (Nagar Nigam) you have to follow the below steps:-

- First of all, go to the Jodhpur Municipal Corporation’s official website i.e. https://jodhpurmc.org/

- Scroll down and click on the option of “Pay Property Tax” on the web homepage.

- Or directly click here => https://nnjsouth.in/

- Now you will land on the PTMS Citizen portal to pay property tax online.

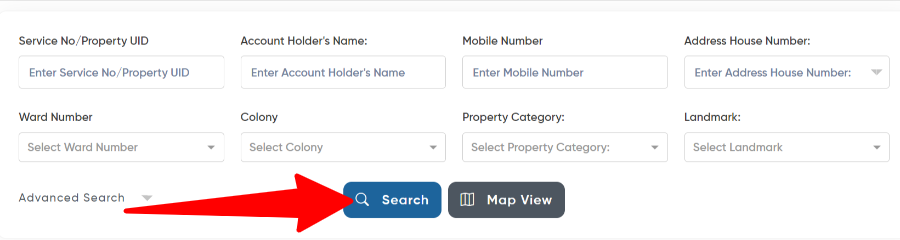

- Here you have to fill Service No/Property UID, Account Holder’s Name, Mobile Number, and Address House Number.

- Then select your Ward Number, Colony, Property Category, and Landmark and click on “Search”.

- The complete details of your property tax will open in front of you along with the payment amount.

- Now you have to click on the “Online Payment” button here.

- As soon as you click, the next page will open in front of you. Where you have to enter your mobile number, and email and select one of the online payment options.

- After this, you have to complete the payment process. Now you will be informed of successful payment through SMS or mail.

Jodhpur Nagar Nigam Property Tax Payment via Offline Mode

Apart from online payment, you can also make payment by visiting the Jodhpur Nagar Nigam office. For which you have to follow some easy steps.

- For this, you have to go to the office of Jodhpur Nagar Nigam.

- Here you have to get the application form for self-assessment.

- All the information asked in the form has to be filled in correctly.

- After this, you have to submit the Property Tax bill amount along with the filled application form.

- The officer will check your application. If all the information is found correct, your Property Tax bill will be paid. And you will be given its receipt.

Jodhpur Municipal Corporation @nnjsouth.in Contact Details

| Address | Polytechnic College Campus, Residency Road, Jodhpur, Rajasthan |

| Telephone Number | (0291) 2651491, 2651498 |

| Fax Number | 2651464 |

| Email ID | [email protected] |

Citizens here read all the steps to be followed to file a self-assessment of the property tax return in Jodhpur Rajasthan. Read all steps carefully before filing the property tax return to Jodhpur Nagar Nigam @nnjsouth.in. We advise our readers to please download and print the payment receipt for future use.