In Jorhat, a Union Board was established in the year 1880 to maintain local administration and after some years in 1909, it was upgraded to Jorhat Municipal Board (JMB). The board appointed a magistrate to collect taxes and revenues. In the initial period of the Jorhat Municipal Board, it was very small. The total area of the municipal board in the year 1909 was five square kilometers with a total of fifteen wards. Now at present, there are a total of nineteen wards in Jorhat Municipal Board with a total population of 127569. If you want to Pay Property/ House Tax Online in Jorhat Municipal Board, follow this article ahead as we have shared all the details.

Jorhat Municipal Board Pay Property/ House Tax Online

The total of the municipal board has also increased by 4 square kilometers. The present boundaries of the municipality board are Sarbaibhanda from the north, Borpool A.T. Road from the south, and East Bengal Pukhuri. To avail service of payment of property tax, you need to visit the official web portal of Jorhat Municipal Board at jorhatmunicipality.org.

You can check here property tax, water bill, and house tax details properly. Citizens, you must check all details before payment. First of all, calculate your property tax properly according to the tax rates specified. Residents collect receipts after payment of property tax which can be used for future reference. Below we provide you with steps to file a self-assessment of property tax.

Procedures to File Self-Assessment of Property Tax Return (PTR)

- Applicant before pavement of property tax you need to calculate your property tax first. After the calculation of property tax visit the office of the Municipal Corporation and take the application form for self-assessment of the property tax return.

- After that, you need to provide all details in the form correctly as the name of the owner, address, property details, etc. In the application form do not enter any wrong details.

- Then you need to submit a form of self-assessment of property tax return along with the tax amount to the cash counter of the office.

- After payment, do not forget to collect the receipt which is used for future reference.

How to File Property Tax Return Online at Jorhat Union Board?

To pay property tax returns online in Jorhat Union Board, follow the following steps-

- First of all, you have to visit the official website of the Jorhat Union Board or Municipal Corporation i.e. https://www.jorhatmunicipalboard.in/.

- Now on the home page, you have to click on the link “Pay Tax Online”.

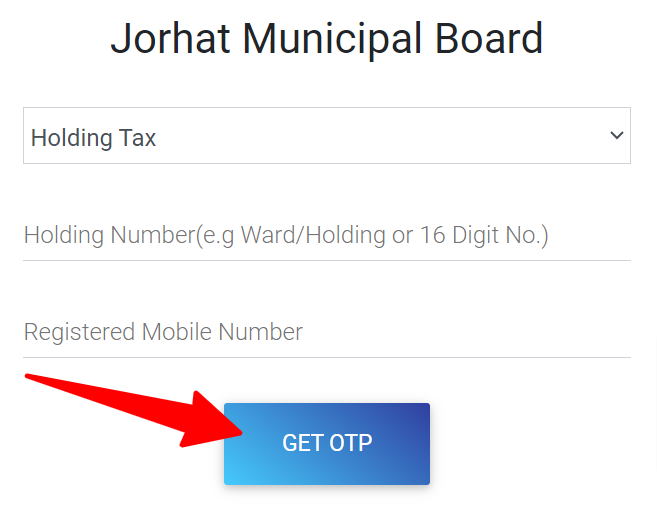

- As soon as you click, the next page will open in front of you. Here you have to first select the tax.

- After this, you have to enter the Holding Number, and registered mobile number and click on “Get OTP”.

- Next, you have to fill in the received OTP and click on Next.

- Then complete information about your property tax will open in front of you.

- Now you have to complete the payment process by clicking on online payment.

- After this, you will receive a payment confirmation message through SMS.

- From here, you can download the receipt of your payment.

Pay Property Tax Return Online on Jorhat Union Board through App

If you want to pay property tax return online on Jorhat Union Board through the app, then for this you have to follow the following steps;

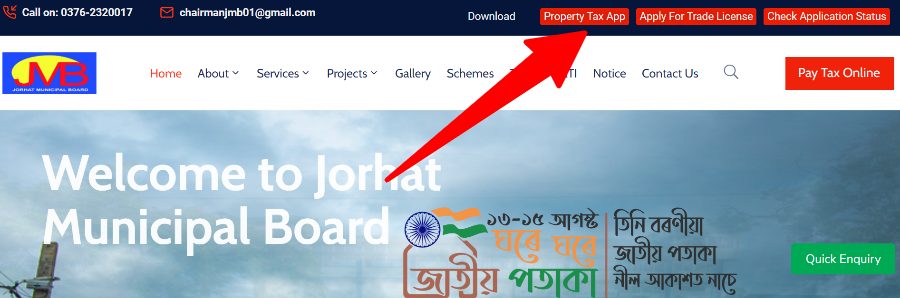

- Go to the official website of Jorhat Union Board at www.jorhatmunicipalboard.in.

- Here you have to click on the link of “Property Tax App” on the home page.

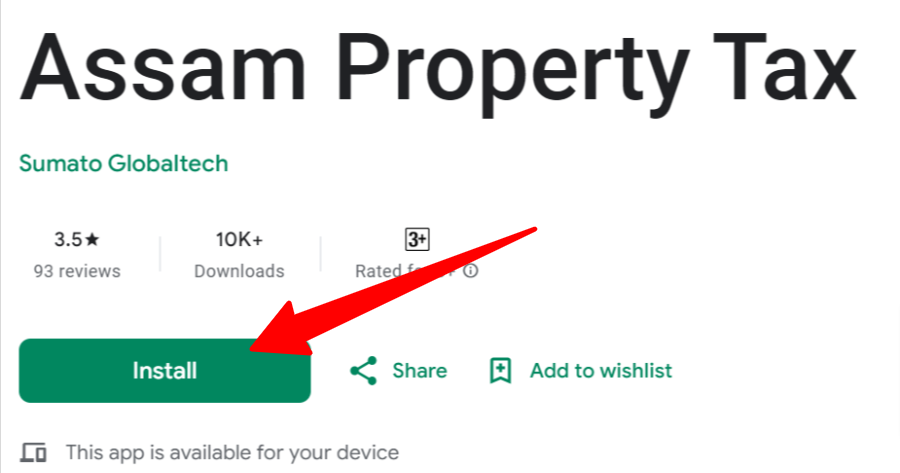

- The Play Store page will open in front of you. Here you have to click on “Install”.

- Next, the app will be downloaded. Now you have to open the app.

- Then log in and click on “Pay Property Tax”.

- On the next page, you have to fill in the asked information and click on “Next”.

- The details of your property tax will open in front of you. From here you have to click on the option of “Online Payment”.

- Next, you have to select the payment option and complete the payment process.

- Finally, click on “Download Receipt” to print your payment receipt.

Contact Details Property Tax Jorhat, Assam Receipt Download

| Address | Unnyan Bhaban Jorhat, Assam- 785001 |

| Telephone Number | 2320017 (STD Code- 0376) |

| E-Mail ID | [email protected] |

| Property Tax Receipt | Download Here |

The user before payment of property tax requires checking all details relating to property tax. You need to check all the details and read all the details given above. Carefully check all details before tax payment. Also, don’t forget to download the Property Tax Jorhat, Assam Receipt for further reference.