Now the citizens of Kolkata city are also able to pay their property/ holding tax online. This can be done by clicking on a few links. The online payment facility for property tax is provided by the Kolkata Municipal Corporation (KMC). The website of KMC is kmcgov. in, which provides the e-payment facility to its citizens and was launched in the year 2010.

In the past few days, property holders have stood in a hectic line to pay their property/ house tax and make various visits to the concerned offices. But after the launch of this website, which would be designed by Tata Consultancy Services at a cost of Rupees Two crore, it made it easier for the process of payment of property tax. Below check the www.kmcgov.in property tax online payment process.

Procedure to Pay Property/ Holding Tax in Kolkata @kmcgov.in

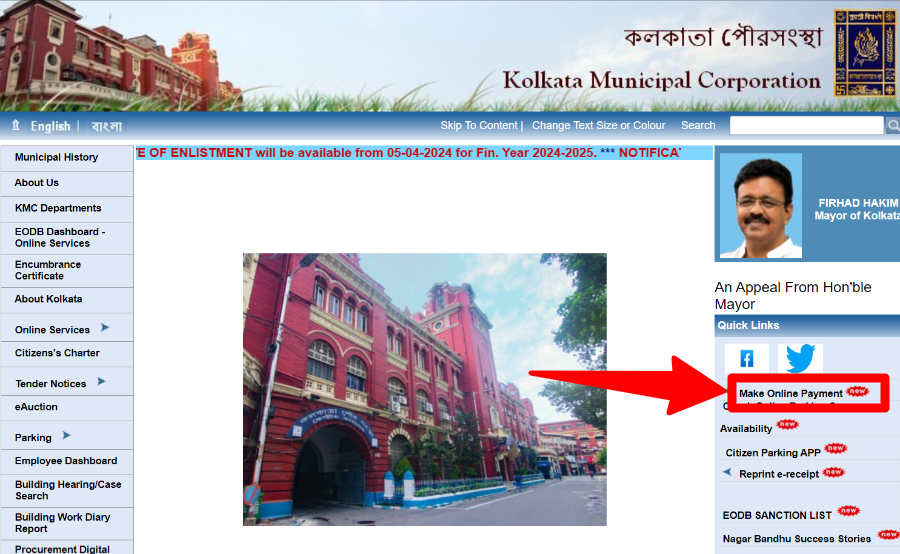

- To make the payment of property/ holding tax online in Kolkata, the user needs to go to the Web Portal of Kolkatta Municipal Corporation, i.e. https://www.kmcgov.in/

- This will show you the home page of KMC, which will provide you the various services.

- To pay property tax, select the online payment link which is shown on the right side of the home page, and then select Property Tax.

- The property tax option is further divided into Current PD, Fresh Supplementary, and Outstanding.

- If the user is filling in the property tax for the very first time, then he/she should click on the Fresh Supplementary link.

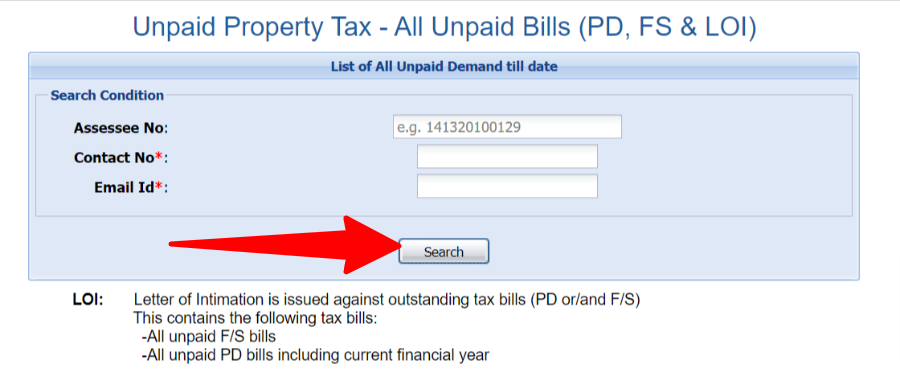

- After clicking on the fresh supplementary link, the user has to fill in some information like Assesse Number, Contact Number, and Email ID. After entering all the information, the user needs to click on the Pay button.

- If the user already paid earlier tax, then he/she has to fill in the same details

- If you want to know the complete details of the property, then the user needs to click on the link ‘Fill up property information form’ and click on details and then proceed with the payment.

Steps for www.kmcgov.in property tax online payment

- For unpaid property tax, the user can follow the link => https://www.kmcgov.in/KMCPortal/jsp/KMCAssessmentCurrentPD.jsp

- Click on the link https://www.kmcgov.in to directly fill out the property information form.

- To obtain the printout of the unpaid bill, the user needs to click on ‘Print Unpaid Bill’.

- If the user wants to check the tax payment status, then he needs to click on Check Payment methods’.

- After filling in the desired details on the page, the user can proceed with the payment option and hence the online payment of property tax is done.

- If the user has any confusion, then he/she can contact any of the members by clicking on the link https://www.kmcgov.in/KMCPortal/jsp/AssessmntContact.jsp.

- If the user wants to know more information about the online tax payment procedure, then he can click on the link https://www.kmcgov.in/KMCPortal/jsp/KMCAssessmentHome.jsp

Information related to Property Tax @www.kmcgov.in

- The user can make payment of property tax every quarter.

- A rebate of 5% will be given to those users who will pay the taxes within the due date.

- An additional 5% rebate will be given to those users who will pay the taxes for the second, third, and fourth quarters within the due date of the property tax payment of the first quarter.

- KMC Property Tax Bill Download @kmcgov.in

How to Pay Kolkata Municipal Corporation Property tax through offline mode?

If taxpayers want to pay property tax through offline mode, they can visit the following centers

- P-187, CIT Road, Kankurgachi V. I. P. Market, Kolkata – 700 054, Ward – 3328A, K. N. Sen

- Road, Kasba, Kolkata – 700 042, Ward – 67

- 11, Belvedere Road, Kolkata – 700 027, Ward – 74

- 212, Rashbehari Avenue, Kolkata – 700 019, Ward – 68

- 516, D. H. Road, Kolkata – 700 034, Ward – 130

- Baghajatin Market Complex, Unit 2, Raja SC Mullick Road, Kolkata – 700 092, (Beside RAKTAKAMAL CLUB)

- 79, Bidhan Sarani, Kolkata – 700 006, Ward – 11

- 56/1 Raja Rajballabh Street, Kolkata – 700 003, Ward – 8

List of other Common Collection Centres

- CMO Bldg., 5, S.N.Banerjee Road, Kolkata-700013

- 10, B.T.Road, Kolkata-700002

- 22, Surya Sen Street, Kolkata-700012

- New Alipore Market Complex, Beside Durgapur Bridge

- 180, N.S.C. Bose Road, Kolkata-700040

- C.I.T. Market, Jadavpur, Central Road, (8B Bus Stand) Kolkata – 700032

- 28, Prince Anwar Shah Road, Kolkata – 700033

- K.M.C. Super Market, Santoshpur Avenue, Kolkata-700075

- E/3, Circular Garden Reach Road, Kolkata – 700024

Kolkata Municipal Corporation Contact Details

| Address | 5, S.N.Banerjee Road, Kolkata 700 013, India |

| Phone No. | +91 33 2286-1000 (28 Lines) |

| Control Room | Ph: +91 33 2286-1212/1313/1414 Fax +91 33 2286-1444 |

| Call Centre | Ph: 2226-9909, 18003453375 (Toll Free) |

| WhatsApp No. | 8335988888 |