The Kurnool is one of the districts of state Andhra Pradesh and it is located in the west-central part of the state. The total population of the district is approximately 3529494 which is 23.16% of the total population of Andhra Pradesh. For the urban local bodies, the property tax is one of the main sources of revenue. All the properties that are situated within the limit of Kurnool Municipal Corporation limits are assessed for tax and according to such assessment property taxes are levied on the property.

The property tax is calculated based on annual rental value and tax rate which is prescribed by the concerned department. Some other parameters are important for the calculation of property tax like the plinth area, the zonal location of the property, the type of construction, the status of the property, and the age of the property. In case of new property, the owner of the property needs to register of property to the municipal corporation in whose jurisdiction the property is situated.

Kurnool Municipal Corporation KMC Property Tax

After completing a registration and all verification processes, the concerned authority issues the door number, property ID, and assessment number. The user needs to mention the door number in front of the property. You can pay property tax in Kurnool City with the help of the official web portal of Kurnool Municipal Corporation.

You can also use helpline numbers in case of any problem relating to the payment of property tax. It provides you with many services as applying for birth certificates, death certificates, water supply connection, payment of property tax, etc. The user can avail of any service at any time from any place.

Kurnool Municipal CorporationOnline Property Tax Payment Process

To pay property tax online in Kurnool Municipal Corporation you need to follow the following steps.

- For this, first of all, you have to go to the official website of the Commissioner & Director of Municipal Administration Government of Andhra Pradesh. Whose link is given below –

Kurnool Municipal Corporation => Click Here

- After clicking on this link, the home page will open in front of you.

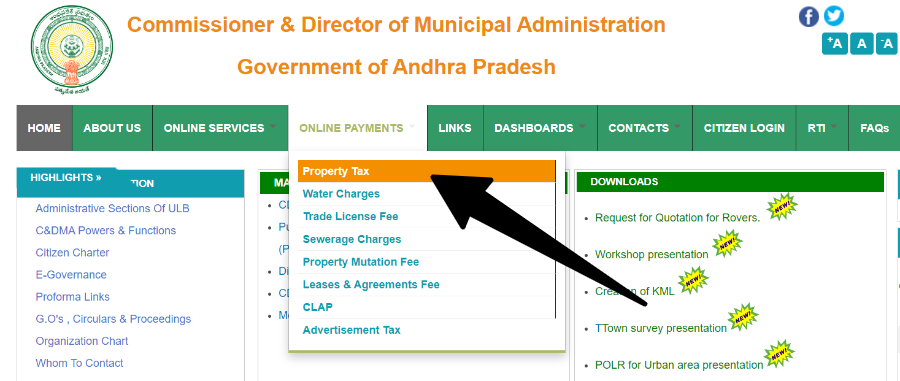

- Now you have to click on the link of “Property Tax” under “Online Payment” on the home page.

- After this, the page of online payment will open in front of you.

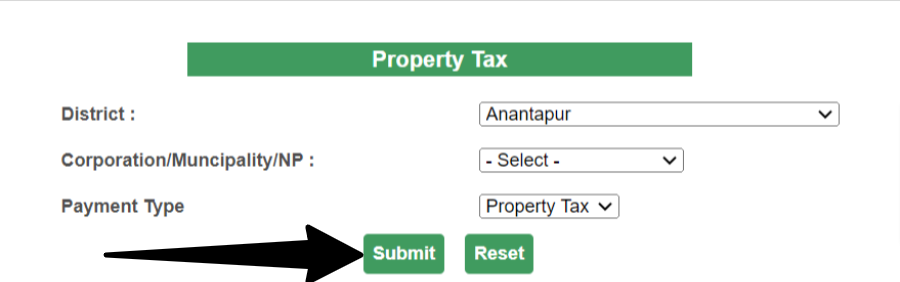

- Here you have to select your district, corporation/municipality / NP, and payment type and click on the “Submit” button.

- As soon as you click, the page “Find Your Property” will open in front of you.

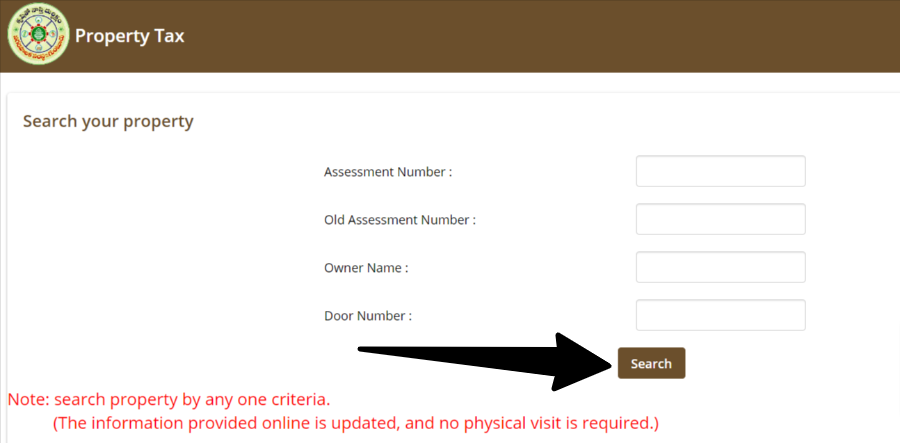

- Here you have to enter the Assessment Number, Old Assessment Number, Owner Name, and Door Number and click on “Search”.

- After this, the complete details of your property tax will open in front of you.

- Here you have to pay your tax by clicking on the payment link and selecting one of the payment options.

Process to Calculate Property Tax in Kurnool Municipal Corporation

Kurnool Municipal Corporation provides you with the service of online calculation of property tax. For this, you have to follow the procedure given below.

For this, first of all you have to visit the official website of Commissioner & Director of Municipal Administration Government of Andhra Pradesh. Here you have been given a direct link.

Calculation of Property Tax Online=> Click Here

- As soon as you click on the link, you will reach the home page of the official website of the Commissioner & Director of Municipal Administration Government of Andhra Pradesh.

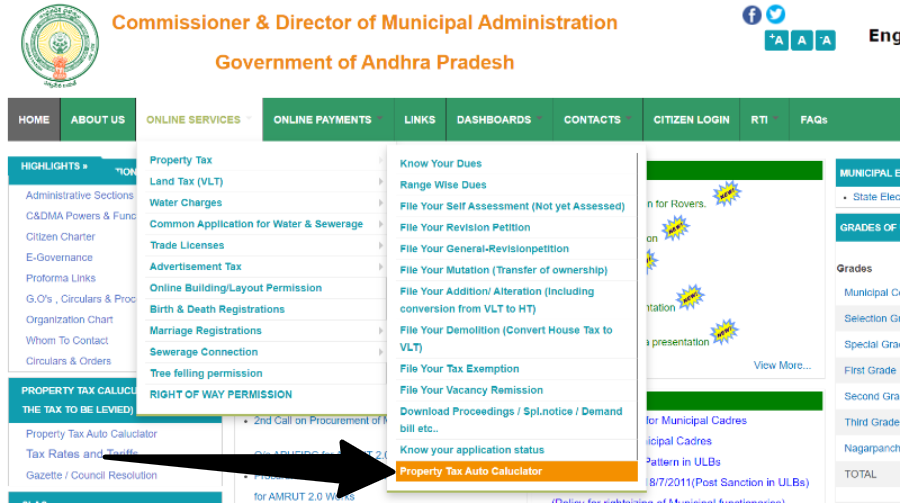

- Here you have to click on Online Service => Property Tax => and then Property Tax Auto Calculator. As shown in the picture below.

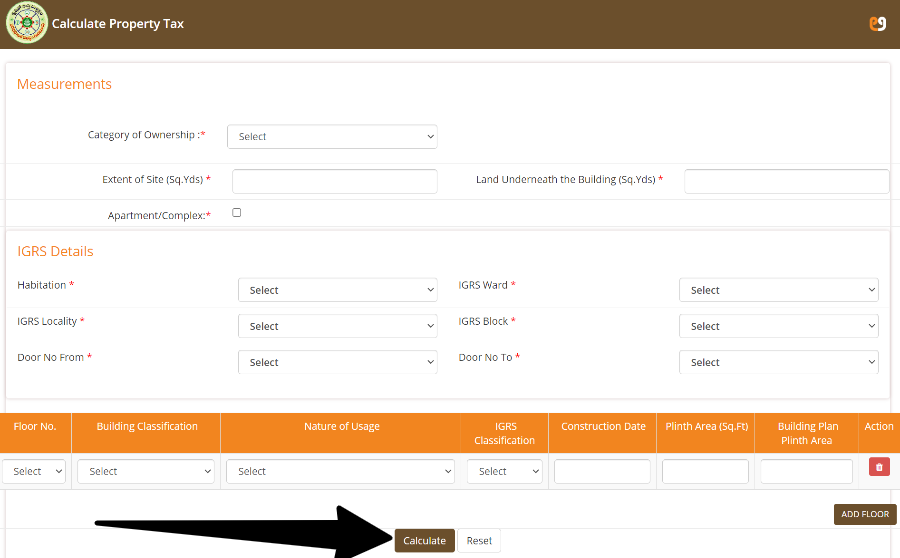

After this, the next page will open in front of you where you have to select District, and Corporation/Municipality/NP and click on “Submit”.- Now a new page will open in front of you. Here you have to fill in all the information asked correctly.

- First of all, information related to Measurements has to be provided.

- After this, details of the Integrated Grievance Redressal System (IGRS) have to be provided.

Now finally you have to select Floor No., Building Classification, Nature of Usage, IGRS Classification and provide information about Construction Date, Plinth Area (Sq. Ft), and Building Plan Plinth Area.

Now finally you have to select Floor No., Building Classification, Nature of Usage, IGRS Classification and provide information about Construction Date, Plinth Area (Sq. Ft), and Building Plan Plinth Area.- After this, finally, you have to click on “Calculate”. In this way, you can easily calculate your property tax online

Complaint & Contact Details

| Address | N.R. Peta, Kurnool, Andhra Pradesh- 518004 |

| Telephone Number | (08518) 221847, 221848 |

| Fax Number | 221764 |

| Help Line Number | 1800 425 9766 |

| E-Mail ID | mc[dot]kurnool[at]cdma[dot]gov[dot]in |

Citizens here read the steps for payment of property tax and calculation of property tax online. Before payment of property tax in Kurnool Andhra Pradesh, check all details given above carefully.