It is not difficult to pay property tax in Patna like the other cities. It has become easy for the citizens of Patna to property taxes online. Patna Municipal Corporation had started an online facility to pay the municipal taxes. To every property holder, Patna Municipal Corporation has issued a unique holding number. Now the taxpayers do not need to make many rounds to the Patna Municipal Corporation to make inquiries or payment of property tax or get the details of their property.

The official website of Patna Municipal Corporation is pmc.bihar.gov.in, where the property holder can search for their Notice Number by entering their Revenue Circle, ward number, Property ID, Old and New Holding Number, and by entering Owner Name. The property holder can file their Property Tax Return by selecting File PTR or Pay Tax and Notice Number and by clicking on the Submit box.

Patna Municipal Corporation Property Tax

Patna Municipal Corporations has also opened Citizen Civic Centres for the payment of holding tax of property tax. Property tax is the major source of revenue for Patna Municipal Corporation to upkeep the basic civic services in the city. The Patna Municipal Corporation gets the major revenue from property tax, which is used to keep the public services in Patna. Presently in the record of PMC, there are two lacs fifty thousand holdings in the documentation.

To file the Property Tax Returns for the year 2020, the property holders can submit the dues before 1st April 2015. The Property tax can be submitted by the holders annually it has become compulsory for the property owner to submit their property tax return annually to the Patna Municipal Corporation. This is the first time that Patna Municipal Corporation has started a self-assessment-based system. PMC sends notices to the property holders at their doorsteps.

In case the property holders cannot receive any notice, he/she can search their property and notice by entering their Property ID or New/Older Holding number or Owner Name and by entering the Owner’s Father/Husband Name. If the property holder finds more than one notice can submit a Property Tax Return against only one notice. If the property taxpayer does not find any notice number then he/she can meet at their nearest civic center along with their previous year’s property tax payment receipt and they can help you in filling out the property tax return.

How to file Property Tax Returns through offline mode in PMC Patna

- The property holder needs to file the Property Tax Return at your nearest civic centers, which are enabled through Patna Municipal Corporation.

- Then you need to make a signature on the hard copy of the Self Assessment Form and then submit it to the circle office of Patna Municipal Office.

- It can also be submitted to the nearest civic center along with previous years’ Property Tax receipts.

- The property holders can get the contact details of civic centers and cyber café from the given list:-

- Maurya Lok I:

Kundan Choudhary(Operation Manager) – +91 9204056085

Aman Kumar(Center Incharge) – +91 92040 56076

Vikas Kumar(Executive) – +91 9693963191 - Maurya Lok II:

Sarvjeet Singh(Team Leader) – +91 9204056075

Arti Kumari(Center Incharge) – +91 8541935959 - NCC:

Ajit Kumar(Center Incharge) – +91 9204056074

Nitesh Kumar(Executive) – +91 7870462273 - Kankarbag:

Dipendra Tiwari(Center Incharge) – +91 9234066406

Subham Kumar(Executive) – +91 9334021233 - Bankipur:

Manish Kumar(Center Incharge) – +91 9135072556 - Patna City:

Surendra Kumar(Center Incharge) – +91 7488117144

Anish Kumar(Executive) – +91 9955834925 - Head Office:

Rahul Kumar(Center Incharge) – +91 7079191656

- Submit the filled Self Assessment Form to the Civic Centre or Cyber Café.

- In case you are submitting it for the very first time, then you need to go to your nearest civic center or RTPS counter in the circle offices of Patna Municipal Corporation carrying your registry paper, electricity bill, and Photo Identity. All the copies must be self-attested.

- After submission, the civic center operator will give a computer-generated PID of your property.

- Generate the challan by selecting your chosen payment way for submitting the property tax.

Patna Municipal Corporation Property Tax Payment Online Property Tax Payment

To file an online property tax return for Patna, you have to follow the steps given below.

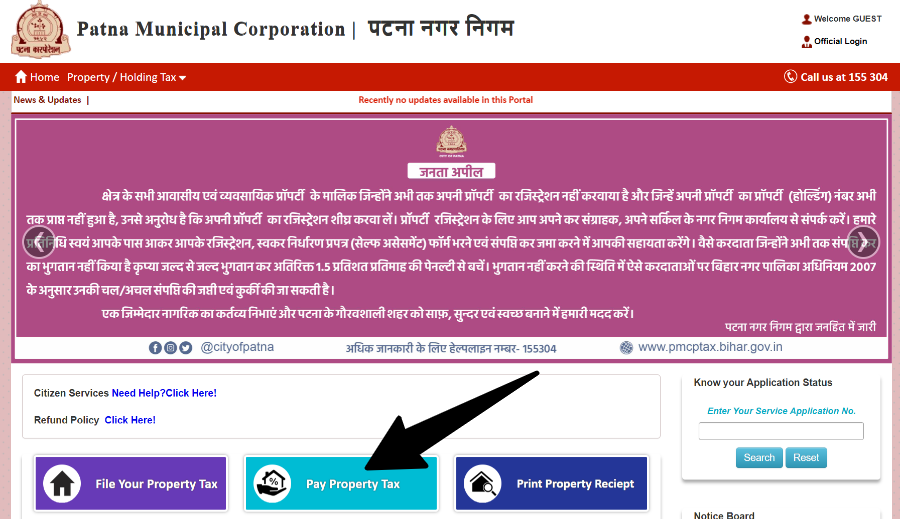

- For this, first of all, you have to go to the official website of Patna Municipal Corporation https://pmcptax.bihar.gov.in/.

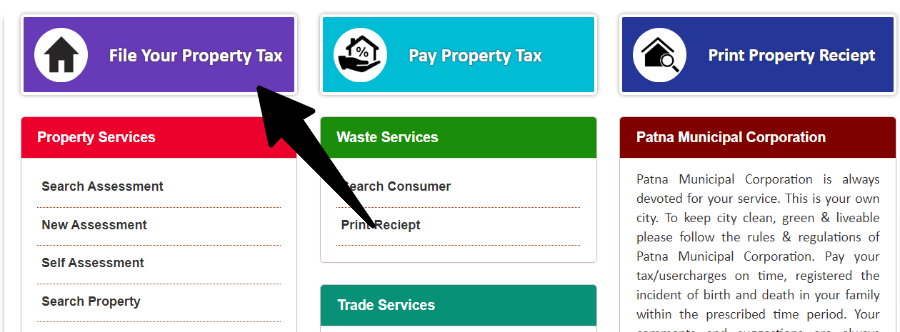

- Here you have to click on the link “File Your Property Tax” on its home page.

- As soon as you click, the option of Search Property will open in front of you. Where you will have to fill in some information.

- Here you have to enter Property No. / Old PID, SAS No., Circle Name, Ward Number, New Holding No. / Old Holding No, and Owner Name, and finally click on Search.

- In this way, you can easily file your property tax return online at Patna Municipal Corporation

Patna Municipal Corporation Print Receipt

If you want to pay Patna Municipal Corporation property tax Receipt online, then for this you have to follow the following steps.

- For this, first of all, you have to go to the official website of Patna Municipal Corporation. The link of which is given below.

Patna Municipal Corporation=> https://pmcptax.bihar.gov.in/

- On clicking here, the home page of Patna Municipal Corporation website will open in front of you.

- Here you have to click on the link “Print Property Receipt”.

- Now the next page will open in front of you. Here you have to fill in the following information.

- Property No. / Old PID, SAS No.,

- Circle Name,

- Ward Number,

- New Holding No. / Old Holding No,

- and Owner Name

- After filling in all the information, you have to click on “Search”.

- On clicking, the details of your property tax will open in front of you.

- Here you have to click on the payment option. And you have to pay the tax through an online medium. In this way, you can easily pay your property tax online.

- After that Print your Receipt online.

Contact & Complaints

| Head Office | Second Floor, Block-C, Maurya Lok Complex, Budh Marg, Patna, Bihar – 800001 |

| Contact No. | 0612 – 2223791 |

| Email ID | [email protected] / [email protected] |