Property Tax has been named as Holding Tax in the Odisha Municipal Corporation Act, 2003. The property tax is one percent of annual value and it is the prime source of Revenue for Odisha Municipal Corporation. Any citizen who holds any property and comes under the jurisdiction of a Municipal Corporation has to pay property tax as per the OMC Act.

As per the Odisha Municipal Act, any holder of property under the Municipal Corporation limit must have to pay property tax. The property tax can be charged seventeen point five percent (17.5%) of the annual value of the holding of the property. It depends on the nature of the holder (residential or commercial). Below check Odisha e Municipality Holding Tax Online Payment process.

How to Pay Holding Tax in Odisha Municipal Corporation (OMC)?

- First, you have to visit the official portal of Odisha One i.e. https://www.odishaone.gov.in/citizen/

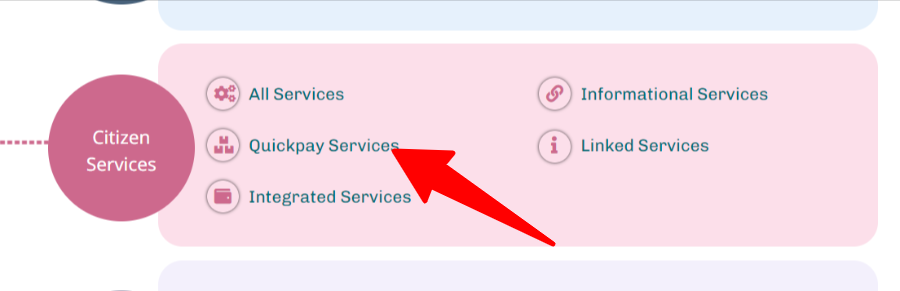

- Here you have to click on “Quickpay Services” on the web homepage.

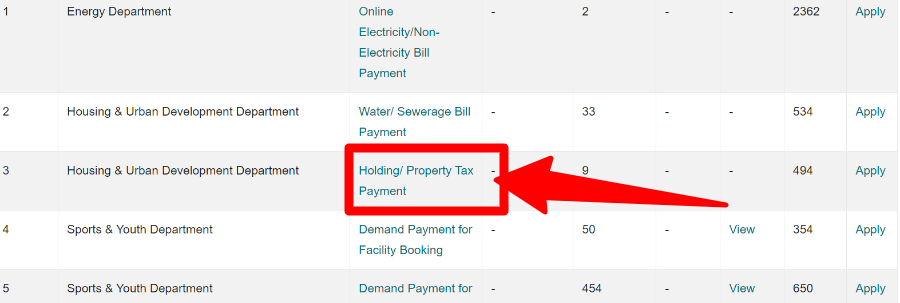

- After this, the next page will open in front of you. Here you have to click on Holding / Property Tax Payment under the Housing & Urban Development Department.

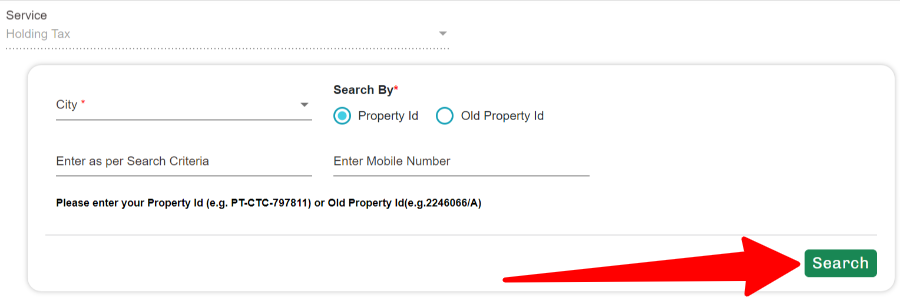

- A new page will open in front of you. Where you have to fill in the following details.

-

- City

- Property Id / Old Property Id

- Mobile Number

- After filling in all the information, you have to click on “Search”.

- Next, your complete property tax details will open in front of you.

- Now you have to click on “Pay Now”. And complete the payment process.

- Finally, you will receive a message of successful payment. After this, you can download the payment receipt by clicking on the print button.

Holding /Property Tax Calculated in Odisha OMC ONline

Residential – The process is as follows-

Stage 1:- Plinth Area of the holding in Square Meter (x) Rs. 13.65

Stage 2:- Subtract fifteen percent (15%) of the Plinth Area against repair and maintenance

Stage 3:- Now Add 0.5% of the land cost where the holding of residential property is located.

- Annual Value = Stage 1 + Stage 2 – Stage 3

- Holding Tax is charged as @17.5 percent per annum of the Annual Value.

- Holding Tax is charged as 10%

- Latrine Tax is charged at 2.5%

- And Street Light is charged as 5%

Commercial property – The process is as follows-

- Stage 1:- Here the user has to add the civil cost of the building (+) the cost of PH and Electric fitting.

- Stage 2:- In this stage, the user has to take 7.5% of the value that comes through Stage 1.

- Stage 3:- Now Add 0.5% of the land cost with Stage 2

- Stage 4:- 17.5% of the cost which we get at Stage 3 is the Holding Tax can be paid yearly.

How to Pay Holding Tax Offline in Odisha

To pay the Holding/Property Tax, you can go to your concerned Odisha e-municipality office of the Tax wing. Provide the approved building plan’s copy to the officials for facilitating the evaluation of Holding/Property Tax.

ULB Odisha Holding Tax – SUJOG’s property tax service facilitates citizens to pay the required property tax to their respective urban local bodies. Citizens can now apply for property reassessment and transfer of ownership of their properties through SUJOG. Citizens do not need to physically visit ULBs to pay their taxes but can access SUJOG remotely to avail of the services.

ULB Odisha Holding/Property Tax Services

The property tax system provides a digital interface to perform property valuation, pay property tax, generate payment receipts, and monitor tax collection. It can be used by citizens, urban local body (ULB) counter and field staff, and ULB administrators to carry out their specific tasks. It is available as a mobile and web-based application.

- Register new property

- Edit existing property

- Transfer property

- Initiate revaluation

- Pay your property demand online

- Track your application status