In those cases which are considered complex, we believe in the words of any mouth that comes our way. However, in serious cases as assets, public opinion should not be our guide. If you have recently purchased a property, it is important to understand your tax liabilities. There can be major financial loss due to any confusion in this regard. We rely on the four common myths associated with property tax in India:

gulbargacity.mrc.gov.in Kalaburagi File PTR & Dues

| Myth | Fact |

| Property tax can be paid at any time. | You can pay your property tax on both a semi-annual and annual basis. In case of payment delay, the penalty is imposed.

However, municipal bodies are often seen to expand the plans to encourage taxpayers to pay a huge margin to pay off the penalty amount. |

| My tenant will pay property tax on the rental unit. | As the owner of the property, the landlord is responsible for paying the property tax, and not the tenant.

Forcing your tenant to do so is illegal, tenants are responsible for paying the levy. |

| The central government determines the rate of property tax. | Land in India is a state subject and the District Municipal Body assists in the collection of property tax.

Typically, urban local authorities are responsible for assessing your property and collecting taxes accordingly. |

| I can take advantage of the exemption under any circumstances if I am a senior citizen, a woman, or a disabled person. | This is true till your property is not rented – it means that the property itself should be occupied to claim the rebates.

If your property comes to a place that suffers from natural disasters or if you are an employee of the Indian Military Service then you can enjoy the concession. |

How to Search Property Online at Kalaburagi City Corporation

If you have the property under the Kalaburagi City Corporation then you can check it online. To search for the property just click on the below link;

On that page, you will have to fill in the following information.

- Firstly enter the old municipal number of your property.

- Secondly, fill in the correct and valid property ID number (PID No.)

- Thirdly you have to give details with ward number or name, block or locality, and street name.

- Now in the next section enter the receipt number.

- Fifthly fill in the Khata number of your property here.

- Sixthly write the name of the assessee or property owner name.

After filling in all the above information you will have to press the “Search” button. On the next screen of your computer, you can see the complete details of your property.

Property Tax Calculator of Kalaburagi City Corporation

If you don’t know the due amount of your Kalaburagi property tax or house tax then don’t worry. Here we are providing you the link where after filling in the Information on the Property and Owner details you will be able to check it.

- You can calculate the Kalaburagi property tax which you have to pay in favor of Kalaburagi City Corporation.

- Calculate your Kalaburagi property tax by using the Property ID (PID) on the Aasthi Tax Calculator.

- The link is available below where you have to enter “Select Year” and “Property Id”.

How to Pay Kalaburagi Property Tax Online?

Kalaburagi Mahanagara Palike also known as the Gulbarga Mahanagara Palike has the responsibility to handle all the works related to the municipal corporation and city administration.

For making the payment regarding the Kalaburagi property tax or house tax you will have to follow the below guideline.

Kalaburagi Property Tax Payment using Offline Mode

- First – Visit the nearest Kalaburagi Municipal Corporation office in your area.

- Second – You will have to take the property tax invoice with you in the office.

- Third – In the office pay the due property tax amount using cash or card.

- Forth – After the payment collect the acknowledgment receipt of payment.

Kalaburagi House Tax Payment Using Online Mode

For online payment, you just have to visit the Kalaburagi City Corporation website below link. On the below available link, you will have to fill in the following information. See the link and check the details also.

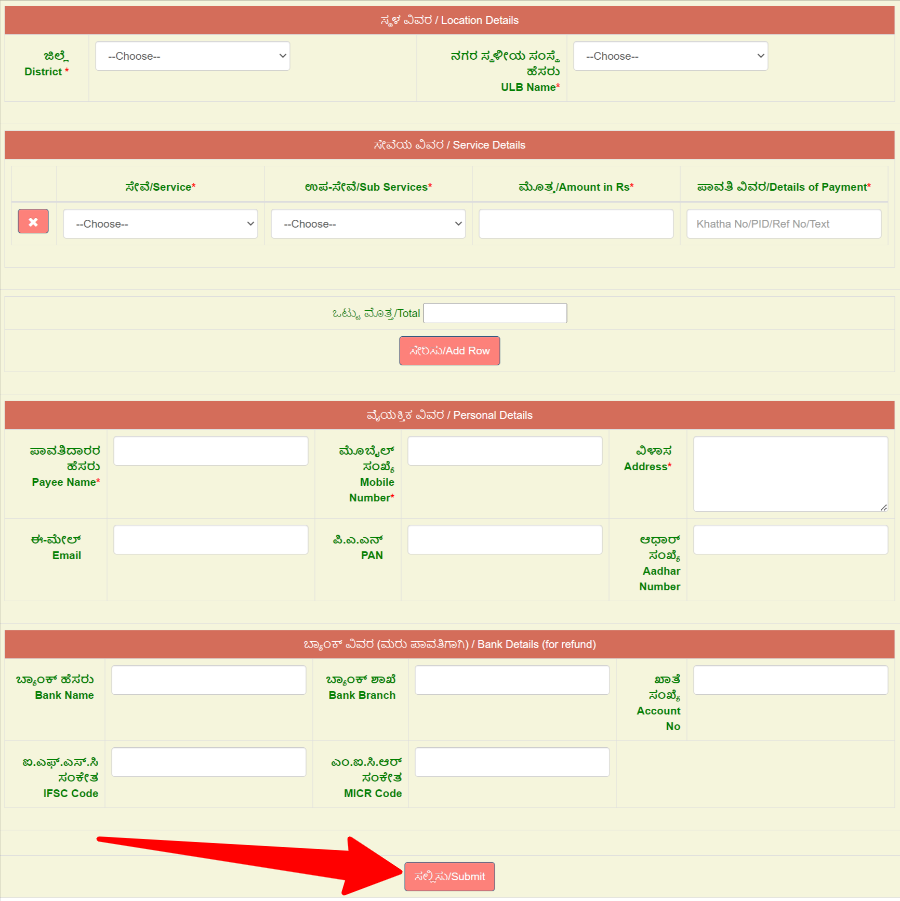

- Location Details (ಸ್ಥಳ ವಿವರ) -: Here select the District (ಜಿಲ್ಲೆ) first and ULB Name (ನಗರ ಸ್ಥಳೀಯ ಸಂಸ್ಥೆ ಹೆಸರು).

- Service Details (ಸೇವೆಯ ವಿವರ) -: In the second section firstly enter (ಸೇವೆ/Service), secondly select the Sub Services (ಉಪ-ಸೇವೆ), thirdly fill the Amount in Rs (ಮೊತ್ತ), and fourthly fill the Details of Payment (ಪಾವತಿ ವಿವರ).

- Personal Details (ವೈಯಕ್ತಿಕ ವಿವರ) -: In this, you have to enter, the payee name, Mobile Number, Address, Email, PAN, and Aadhar Number.

- Bank Details – For the refund (ಬ್ಯಾಂಕ್ ವಿವರ – ಮರು ಪಾವತಿಗಾಗಿ) -: Fill Bank Name, Bank Branch, Account No, IFSC Code, and MICR Code details here.

After filling in all this information press the “Submit” button. On the next page, you will see the payment option. Now you can pay the due house tax amount in favor of Kalaburagi City Corporation (Gulbarga Municipal Corporation). After making the payment download the acknowledgment slip.

Gulbarga / Kalaburagi City Corporation Contact Details

| Office Location | Kalaburagi City Corporation, Near Jagat Circle, Main Road, Kalaburagi – 585102. |

| Phone Number | 08472-278675 |

| Help Email Id | [email protected] [email protected] |

| Official Website | www.gulbargacity.mrc.gov.in |