The city of Rajamahendravaram is situated near the Godavari River in the state of Andhra Pradesh. It is also known as the cultural capital of Andhra Pradesh. The city of Rajamahendravaram is located in the Vijayawada division of the South Central Railway. There are two bridges in the city on the Godavari River which were constructed more than 150 years ago. In the city, there is one largest rail bridges in Asia. The city of Rajamahendravaram has a pleasant climate from November to January month and from July to October experiences rain.

In the year of 1865 the Rajamahendravaram Municipal Corporation was graded as a third-class municipality and in 1980, the corporation was upgraded to the selected grade of the municipality. The city is also famous for rice production. The city is fast growing in the field of trade and commerce. Rajamahendravaram Municipal Corporation provides online services to citizens of the city for better and more efficient services. The Municipal Corporation’s main aim is to maintain civic amenities in the city. Rajamahendravaram Municipal Corporation also collects property tax on all property that comes under its jurisdiction. You need to Self-Assessment of property tax return form to pay property tax.

Procedure for Property Tax Online Payment in Rajamahendravaram Municipal Corporation

If you want to pay property/ house tax online in Rajamahendravaram Municipal Corporation (East Godavari), then for this you have to follow the following steps:-

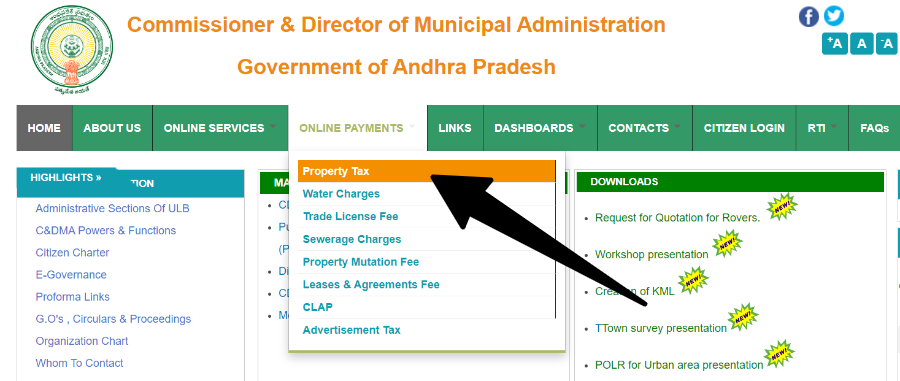

- For this, first of all, you have to go to the official website of the Commissioner & Director of Municipal Administration Government of Andhra Pradesh.

- Here you have to click on the link of “Property Tax” under “Online Payment” on its home page.

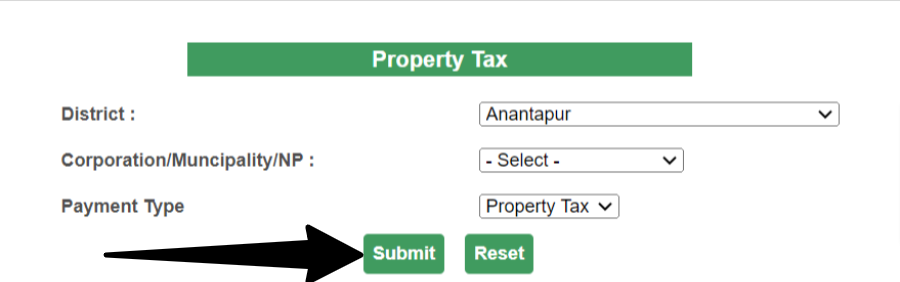

- After this, you will reach the next page. Here you have to select district, corporation/municipality / NP, and payment type.

- Then you have to click on the “Submit button to proceed ahead.

- Now the complete details of your property tax will open in front of you.

- Next, click on the link of online payment here select one of the payment options and make the payment.

- Through this process, you can easily pay your property tax online

Calculation of Rajamahendravaram MC Property/ House Tax Online

If you want to calculate Rajamahendravaram Municipal Corporation property tax online, then for this you have to follow some easy steps. These are as follows:-

- First, you should visit the website of the Commissioner & Director of Municipal Administration Government of Andhra Pradesh. The link of which is given below.

Calculation of Property Tax Online => Click Here

- As soon as you click on the link, you will reach the home page of the official website of the Commissioner & Director of Municipal Administration Government of Andhra Pradesh.

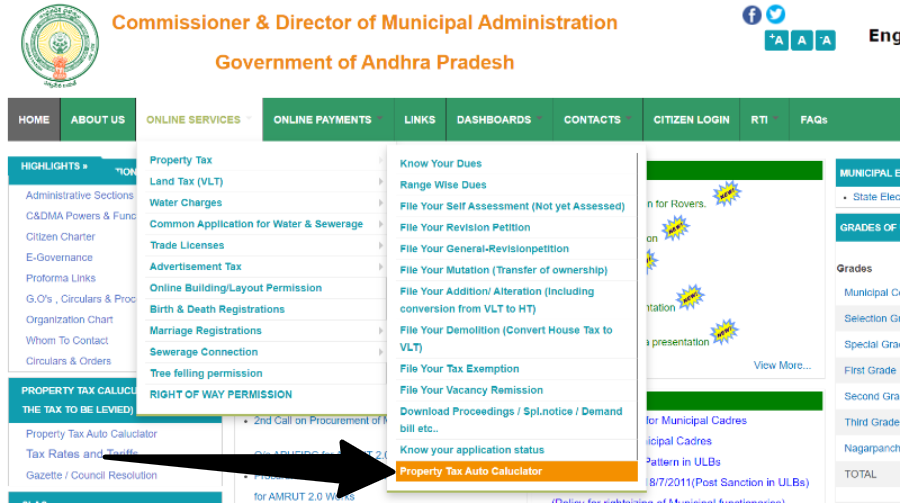

- Here you have to click on Online Services => Property Tax => Property Tax Auto Calculator. As shown in the picture below.

- After this, the next page will open in front of you where you have to select District, and Corporation/Municipality/NP and click on “Submit”.

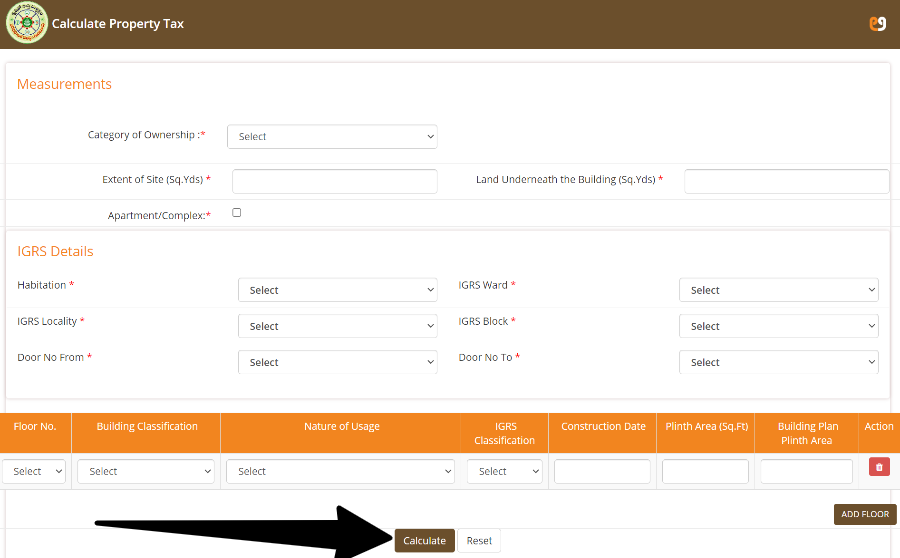

- Now a new page will open in front of you. Here you have to fill in all the information asked correctly.

- First of all, information related to Measurements has to be provided.

- After this, details of the Integrated Grievance Redressal System (IGRS) have to be provided.

- Now finally you have to select Floor No., Building Classification, Nature of Usage, IGRS Classification and provide information about Construction Date, Plinth Area (Sq. Ft), and Building Plan Plinth Area.

- After this, finally, you have to click on “Calculate”. In this way, you can easily calculate your property tax online

Rajamahendravaram (East Godavari) Municipal Corporation Contact Details

| Telephone Number | 0883 – 2479995 |

| Fax Number | 0883 – 2462414 |

| E-Mail ID | [email protected] |

Citizens who want to pay property tax online in Rajamahendravaram Andhra Pradesh need to check all the above-given details and check contact details in case of any problem while payment of property tax.