Rohtak is a district of Haryana state of India. The area of the district is 2,330 square miles and it is located 66 kilometers from India’s capital Delhi. Rohtak is a district of agriculture. This district has five districts of Haryana from all four sides. There are Jind in the north, Sonepat in the east, Bhiwani in the west, Jhajjar in the south, Hisar in the northwest, and Bahadurgarh in the southwest.

This district location is in the north-west of Delhi, on the intermediate highlands of Yamuna and Sutlej rivers. Its northern part is irrigated by the Rohtak and Bootana branches of the Western Yamuna Canal, but most of the intermediate ground is dependent on uncertain natural rainfall. If you live in Rohtak and own any property (residential or commercial) then you should file the property tax returns on time to avoid penalty charges. To learn How to Pay Rohtak Nagar Nigam Property-House Tax Online, kindly go through the complete article below.

Municipal Corporation Rohtak Property Tax/ Bill Payment

All the services for the Property are available on the official portal of Municipal Corporation Rohtak Property Tax Online Portal i.e. https://ulbharyana.gov.in/Rohtak/248. The citizens can obtain various services through this online website. On this page, we will let you know a few following procedures:

- Property Tax Calculator => By using this the citizens can calculate their MC Rohtak property tax amount which they have to pay in favor of the Municipal Corporation of Rohtak through the online/offline mode.

- House/ Property Tax Payment => Under this option the payment gateway for the property/house tax is available. Citizens can use it for submitting their due taxes online.

- DNC Register (Property Tax) => In this section citizens can check all the revenue tax collection by the MC Rohtak. They also can search for their name in this list.

How to Pay House/ Property Tax in Rohtak Municipal Corporation?

Follow all the instructions available on this page to obtain the benefits of the above services. Check one by one all the procedures and submit your online tax.

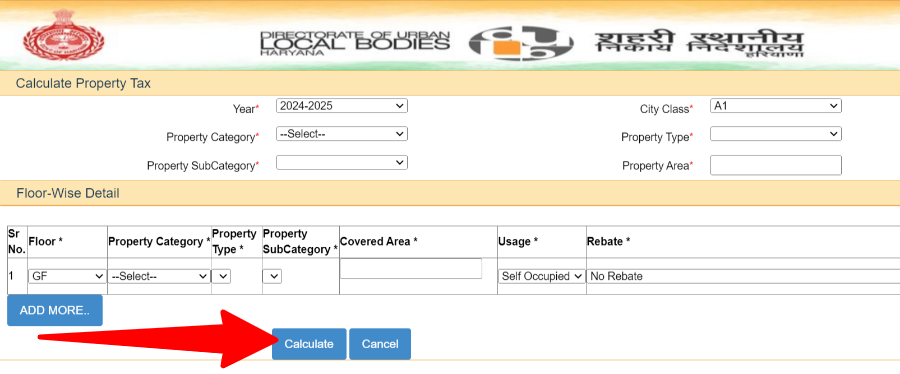

- Firstly, before the payment of Rohtak property tax/house tax, the citizens also can calculate the total due amount through this option. You just simply have to visit the below available link and fill in the following information:

-

- Year

- City Class

- Category of Property

- Type of Your Property

- The sub-category of House/Property

- Area of the House or Property

- Secondly, all the information is mandatory and compulsory to fill here. After filling in all these details press the “Calculate” button and you will see the due house tax information in the “Floor, Property Category, Property Type, Property SubCategory, Covered Area, Usage, and Rebate” way. Most importantly, you will have to pay the showing amount in favor of Rohtak Nagar Nigam as the house tax.

- After the house tax calculation, the citizens will have to make online payments in favor of Rohtak Nagar Nigam. For making the payment online the link is available below. You can make the payment by entering “Unique Property ID” or by filling in “Location, Owner Name, and Property Address”.

Rohtak Nagar Nigam Pay Property Tax & Due Amount Calculator

- Moreover, in the next step press, the “Search” button and you will see all the due amounts and other details for flavor properties. Then make the payment in favor of Rohtak Municipal Corporation by using an online payment gateway.

- Subsequently, the citizens can use any mode for example credit card, debit card, or internet banking mode. Also, download the payment receipt or acknowledgment slip after submitting the payment online. Meanwhile, save this slip for further help from officials in case of any problem in the future.

- The Nagar Nigam Rohtak also gives the service to check the DNC Register. In this register, the citizens can check all the past and future payments. In short, the citizens can check their names on this list to make sure that the payment is updated on the website.

Municipal Corporation Rohtak Contact Details

In conclusion, if you are having any problems while filing the house tax then contact the Rohtak Municipal Corporation taxation Wing. Similarly, we are providing you the link below where all the department sections’ contact information is available.

However other department’s contact numbers are also available, for example, General Administration Wing, Engineer Wing, Town Planning Wing, Electrical Wing, Fire Wing, Taxation Wing, Sanitation & Health Wing, and Account Wing.

| Taxation Wing Helpline | 08295900950 |

| Dept Contact Details | http://www.mcrohtak.gov.in/contact_us.htm |

| File Online Complaint | http://cmharyanacell.nic.in |

Municipal Corporation Sonepat File Property Tax (PTR) Online