As per the Meghalaya Municipal Act, 1973, the system of self-assessment of holding of property is implemented by the Shillong Municipal Board. The Shillong Municipal Board was constituted under the act of Meghalaya Municipal Act, of 1973. All the responsibility to collect property tax hast Shillong Municipal Corporation Board. The owner of property or holder of property is required to calculate tax on property and deposit it to the municipal board. It is mandatory to file an annual property tax return. Every resident of Shillong, Meghalaya must pay their property/ house tax on time to avoid penalty charges. To know the step-by-step process of Shillong Municipal Board File Property Tax Return Online, Search House Tax @smb.gov.in, and go through the complete article below.

Shillong Municipal Board File Property Tax Return Online

The owner of property or holder of property can take the help of Architects who are registered under the Architects Act, 1972, or any licensed architect in the calculation of tax. In the first section at the time of implementation of self-assessment of the property tax system, the property tax is calculated by the owner of the property. To fill property tax you require Property Tax Identification Number (PTIN).

Shillong is the capital city of Meghalaya state which was planned by the British as a hill resort. The state of Meghalaya is beautiful. There are mountains covered with snow that look so beautiful and adorable. It is one of the low-population states of India. In the year 1872 according to the census, there were only 1368 residents and now there are two lakhs fifty thousand citizens residing in the state. Today, the city of Shillong is known as the heart of education as there are well-recognized schools and colleges in the city.

Online Property Tax Payment in Meghalaya Shillong Municipal Board

To make online property/ house tax payments in Meghalaya Shillong Municipal Board, you have to follow the steps given below;

- First of all, go to the official website of the Shillong Municipal Board i.e. https://smb.gov.in/.

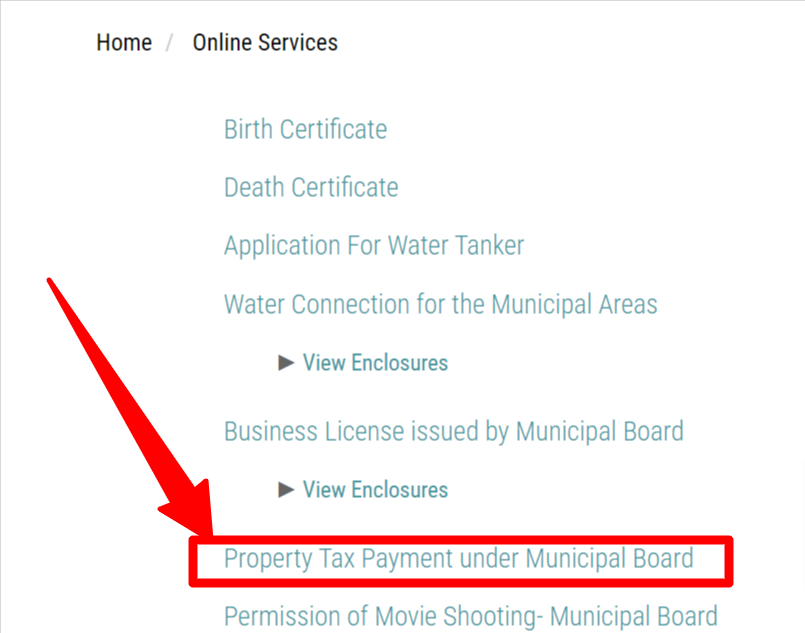

- Here you have to click on the link of “Online Service” on its home page.

- After this, the next page will open in front of you, where you have to click on the link “Property Tax Payment under Municipal Board”.

- Now you have to log in, if you’re a new user then register yourself on the portal first.

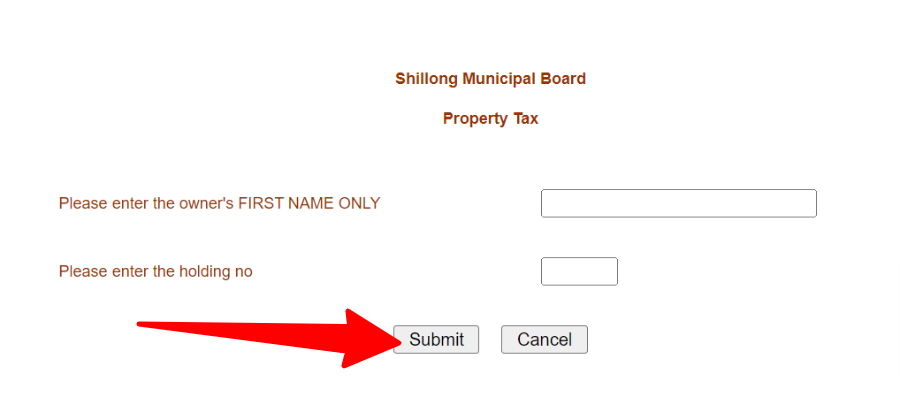

- As soon as you log in, the page of Shillong Municipal Board will open on the next page.

- Next, you have to enter your name and holding number and click on the “Submit” button.

- On the next page, you have to choose the payment option by debit credit card, or net banking.

- After this, you have to fill in the name of UBL, bank details, payment mode, collection date, and collection center and click on “Pay”.

- Now you have to complete the payment process. And you have to download the payment receipt.

Procedure for Shillong Municipal Board Property Tax Offline Payment

You can also pay property tax offline in Meghalaya Shillong Municipal Board, for this, you have to follow the below steps:

- First, visit the Shillong Municipal Board office and get the property tax self-assessment form, or directly click here => SMB Property Tax Self Assessment Form

- Download the form for the assessment of property tax fill it in with all the details in the first part enter your Property Tax Identification Number (PTIN).

- Next, you need to enter details of the holding the owner of the property as name of the owner, name of institution/organization, and if the property is used for non – residential purposes.

- In the third part enter details of households sharing the same building (if more than five).

- After that enter details of the address of the person responsible too filing PTR and payment of tax.

- In the fourth section enter the location and usage of holding/property. Enter the calculation of annual rental value, net tax value, mode of payment, and other required details in the form properly. No detail in the form should be wrong.

- Next visit to the office of Shillong Municipal Board and deposit form along with tax amount. After that, collect the receipt of payment of tax.

Search House Tax @smb.gov.in Contact Details

| Address | Bishop Cotton Road, Shillong, Meghalaya- 793001 |

| Telephone Number | 0364 – 2224702, 2224850, 2501359 |

| E-Mail ID | [email protected] |

| Seach House Tax Details | www.smb.gov.in |

Citizens it is required to pay an annual property tax return to the Shillong municipal board. Above we provide you form and steps to pay property tax. Carefully read all steps properly and then proceed to pay the tax.