Surat is the second largest city of Gujarat state on basis of area and population. It is situated in the western part of India in the state of Gujarat. It is one of the fastest growing and developed cities in India. It is one of the cleanest city in India and also known as “the Silk City, Diamond City and Green City. Surat Municipal Corporation is a local body which came into existence under the Bombay Provincial Municipal Corporation Act, 1949.it carries all functions which are entrusted by the Bombay Provincial Municipal Corporation Act, 1949.

Surat Municipal Corporation Vera bill/Property Tax Payment

The corporation provides a facility for water supply, efferent maintenance of solid waste materials, etc. it proved several numbers of services like issuance of birth certificate/death certificate, a collection of property tax. Property tax is calculated on the basis of an annual rent of property yearly. The department provides a formula for calculation of property tax:

Property Tax = R X M X A

R: Annual rate of property tax

M: product of various factors {(Factor 1) X (Factor 2) X (Factor 3) X (Factor 4)}

A: are of property

The rate of the property is required in square metres (one square meter is equal to 0.092903). There is a different rate of property tax for residential and non-residential properties. The department provides relaxation to residential property owners. You can also calculate your property tax online also through official web portal of Surat Municipal Corporation. Below we provide you steps to pay property tax. Every taxpayer should check all steps carefully to pay property tax properly without any mistake. You can access this web portal 24 X 7 from any place office, house, and metro. You require tenement number to pay property tax which is given on receipt.

Surat Municipal Corporation Property Tax Payment Process

suratmunicipal.gov.in Procedures to Pay Property Tax Online in Surat Municipal Corporation (Surat Nagar Nigam Me Apna Property Tax Return ka Bhugtan Kare)

The property tax is levied on property. Those who have a property such as flat, building, land in Surat Gujarat are a label to pay property tax to department twice in a year. Check steps to make payment of property tax.

You need to calculate tax before payment of property tax. The Surat Municipal Corporation proved facility of calculation of property tax online. Go to the official web portal of Surat to calculate property tax.

Surat Municipal Corporation ->>> Click Here

On the home page of the corporation, select online service and then click on Property Tax. It will take you to next page where the option of calculation of property tax given or check below given direct of tax calculation page.

Calculation of property Tax ->>> Click Here

In the given page, select zone, property tax ward, market location, property type. After that, fill an area of property (in square metres), the age of the property, occupancy (self/tenant), usage, water connection.

After filling all details you need to click on Calculate Tax button. Next, it will provide you total property tax for financial year 2016 -17.

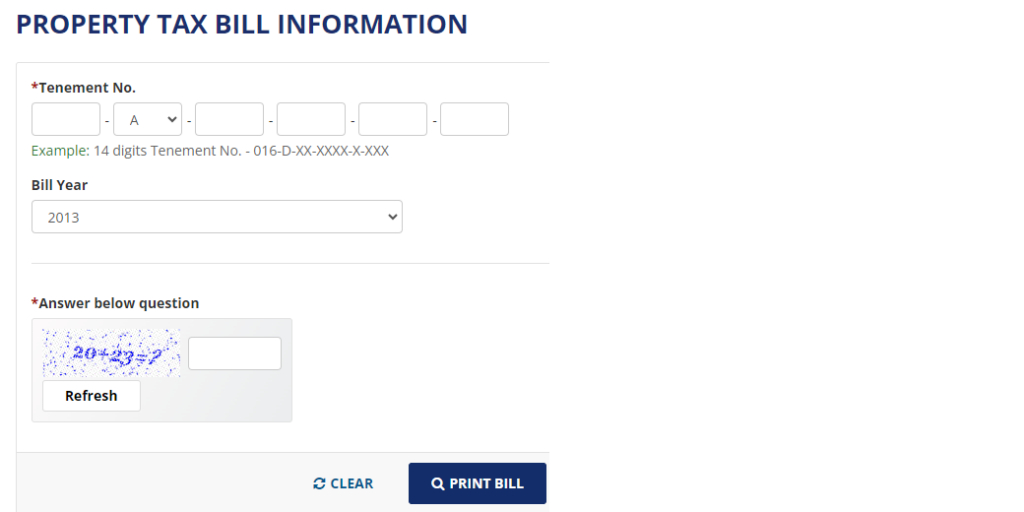

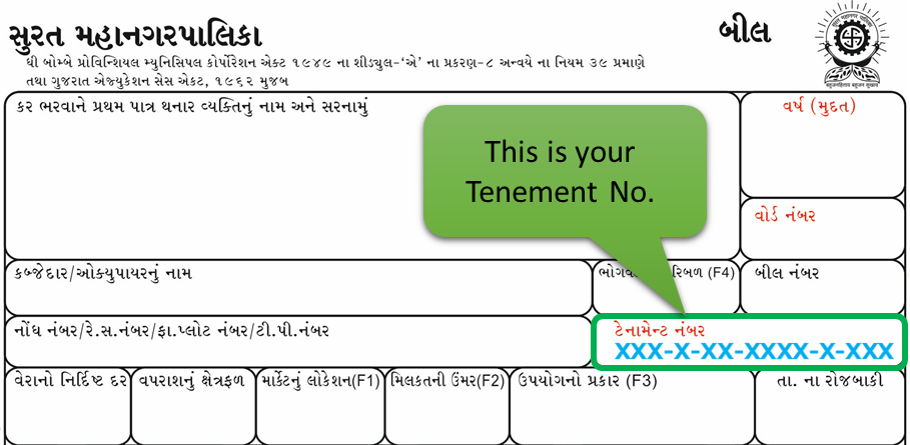

After calculation of property tax, you need to step ahead to make payment of property tax. You can pay property tax online. You require 13 digits tenement number for payment of property tax. If you do not have tenement number, visit municipal corporation office to tenement number. Click to below link for payment of property tax.

Payment of Property Tax Vera Bill Online ->>> Click Here

- In this given page, enter your 13 digits tenement number and click on Get Pending Tax Amount button. It provides you details of your due amount of property tax.

- After checking all details of due / paid amount of tax and then click on Pay button.

- Next step is to select the mode of payment as debit card/credit card or net banking. Select any one option and enter all required details relating to payment.

- Click on Play button to make payment of property tax. After payment of tax, it will provide you receipt which contains transaction number, date, address and name of the owner which acts as proof of payment of property tax.

Note: User e – payment of tax is not viable in between of 23: 30 to 0: 30 hours daily due to the maintenance of the website, so do not make payment in between this time.

- Those who do not have tenement number and check their tenement number with the help of below has given a link.

Tenement Number ->>> Click Here

You can also self-assess your property tax through the guide provided by the department. You can check all details in the guide. Below, check the link to assessment guide of property tax.

Assessment Guide for Property Tax ->>> Click Here

Surat Municipal Corporation Contact / complaint Details

- Address: Gordhandas Chowkhawala Marg, Muglisara, Surat

- Pin Code: 395003

- State: Gujarat

- Telephone Number: 0261 – 2423750 to 2423755, 2422285 to 2422287

- Fax Number: 0261 – 2452937, 2422110

- Control Room: 0261 – 2423751

Contact Details of Zonal Offices ->>> Click Here

Citizens check here steps for payment of property tax. You can make payment of property tax online check above given steps. Carefully check all details or in case of any problem use contact details.