Tiruppur city is situated in the state of Tamil Nadu. It is situated at a distance of 448 kilometers from Chennai. The proper tax is assessed to all those who hold more than one property in the city of Tiruppur. TCMC- Tiruppur City Municipal Corporation collects time property tax from all those who are covered under its jurisdiction. Frequently the property tax is filled twice in a year i.e. half yearly. Every year the municipal corporation faces lakhs of loss of property tax due to nonavailability of proper details of properties. From time to time the municipal corporation assessed and levied property tax. To learn How to Pay Tirupur municipality property/ house tax online, download payment receipts, self-assessment, and other related details, follow this article ahead.

How to Pay TCMC Property/ House Tax Online?

Property tax is levied on residential and commercial both types of properties. If any residential is used for let out then property tax is levied on it. The property tax is also known as the holding tax. You can deposit your property tax through any method provided by the corporation. Those who file property tax for the first time need to test first to get an assessment number to pay property tax.

- We all know that taxes are used by the government to provide better infrastructure and development for the state. It is mandatory to pay property tax on time. Check below given steps for payment of property tax.

- Those who are liable to pay property tax in Tiruppur city need to fill out an application form of self Assessment of Property Tax which can be avail from outside of the Tiruppur Municipal Corporation- TCMC Property Tax portal.

- Next fill in all the details in the application form as the name of the owner, address, and property tax. After filling in all the details property check form is proper.

- After that, you need to submit the form along with the tax amount to the nearest office and take the receipt after submitting of form.

Search Property Tax Due Amount @tnurbantree.tn.gov.in

- You can also search your time property tax due amount information. To check the due amount details you need to visit the official web portal of Tiruppur City Municipal Corporation (TCMC).

Click Here => www.tnurbantree.tn.gov.in/tiruppur

- Here click on the Online Services option to check the tcmc property tax due amount details. It will open a new page on your screen or check the direct link of the page of due tax information.

-

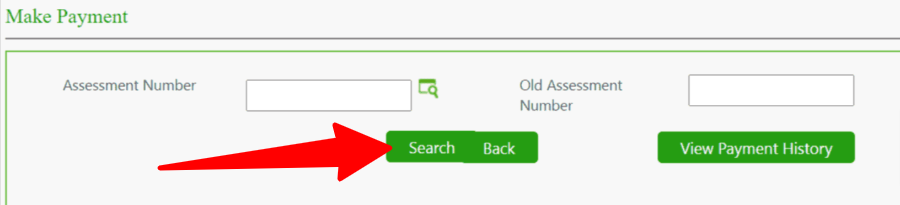

- Enter Assessment Number

- Enter the Old Assessment Number

- Click on the Search Button

- You and check your payment history By clicking on the View Payment History Button

- On this page select the tax type for which you want to check the information and then enter your assessment number, click on the Submit button to check the property tax amount details.

Search Assessment

If you want to search for your assessment details then you need to click on below given direct link. It provides you the option to search for time property tax assessment details.

Select the type of tax as property tax, ward. After that enter your name and door number then click to Submit button to check the assessment details. You can check any year’s assessment details.

Contact Details

| Address | Kumaran Road, State Highway 169, Noyyal, Tiruppur, Tamil Nadu |

| Telephone Number | 0421 – 2242101 |

| Fax Number | 0421 – 2201052 |

| E-Mail ID | [email protected] |